|

PROSPECTUS SUPPLEMENT |

Filed pursuant to Rule 424(b)(5) |

|

|

(To Prospectus dated March 24, 2022) |

File No. 333-263834 |

VERSUS SYSTEMS INC.

2,100,000 Common Shares,

Pre-funded Warrants to Purchase 2,045,000 Common Shares

and

2,045,000 Common Shares Underlying such Pre-funded Warrants

We are offering 2,100,000 of our common shares, no par value per share, together with 2,045,000 pre-funded warrants to purchase common shares (the “Pre-funded Warrants”) pursuant to this prospectus supplement and the accompanying prospectus. The common shares issuable from time to time pursuant to the exercise of the Pre-funded Warrants are also being offered pursuant to this prospectus supplement and the accompanying prospectus.

A holder of Pre-funded Warrants will not have the right to exercise any portion of its Pre-funded Warrants if the holder, together with its affiliates and certain related parties, would beneficially own in excess of 4.99% (or, at the election of the holder, 9.99%) of the number of common shares outstanding immediately after giving effect to such exercise. Each Pre-funded Warrant will be exercisable for one common share at an exercise price of $0.0001 per common share. The offering price is $0.5199 per Pre-funded Warrant, which is equal to the offering price per common share less $0.0001. Each Pre-funded Warrant will be exercisable upon issuance and will expire when exercised in full. There is no established public trading market for the Pre-funded Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Pre-funded Warrants on The Nasdaq Stock Market or any other securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-funded Warrants will be limited.

Concurrently, we will offer in a private placement to the investor 6,217,500 unregistered Series C common share purchase warrants (the “Common Warrants”) to purchase common shares at an exercise price of $0.52 per share. The Common Warrants are exercisable six months following the date of issuance, and will expire five and a half years from the date of issuance. The Common Warrants and the common shares issuable upon exercise of the Common Warrants are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”) and Regulation D promulgated thereunder, and are not being offered pursuant to this prospectus supplement and the accompanying prospectus. There is no established trading market for the Common Warrants and we do not expect a market to develop.

Our common shares trade on the NASDAQ Capital Market under the symbol “VS.” The last reported sale price of our common shares on the NASDAQ Capital Market on July 13, 2022 was $0.54 per share. For a more detailed description of our common shares and the Pre-funded Warrants, see the section entitled “Description of the Securities we are Offering” beginning on page S-13 of this prospectus supplement.

As of July 13, 2022, the aggregate market value of our outstanding common shares held by non-affiliates was approximately $11,560,907 based on 20,754,424 common shares outstanding, of which 4,473,750 shares were held by affiliates as of such date, and a price of $0.71 per share, which was the last reported sale price of our common shares as quoted on the NASDAQ Capital Market on June 2, 2022. Accordingly, we are subject to the limitations set forth in General Instruction I.B.5 of Form F-3. During the 12-month period prior to and including the date of this prospectus supplement, we did not offer any securities pursuant to General Instruction I.B.5 of Form F-3.

|

Per Common |

Per Pre-funded |

Total |

|||||||

|

Offering price |

$ |

0.52 |

$ |

0.5199 |

$ |

2,155,195.50 |

|||

|

Placement Agent’s fees |

$ |

0.04 |

$ |

0.0416 |

$ |

172,415.64 |

|||

|

Proceeds, before other expenses, to us |

$ |

0.48 |

$ |

0.4783 |

$ |

1,982,779.86 |

|||

We have retained Roth Capital Partners LLC to act as exclusive placement agent (the “Placement Agent”) in connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to sell the securities offered by this prospectus supplement and the accompanying prospectus. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. The Placement Agent will receive compensation in addition to the Placement Agent fees. We have also agreed to issue to the Placement Agent warrants to purchase up to 331,600 common shares and to indemnify the Placement Agent. See “Plan of Distribution” beginning on page S-15 of this prospectus supplement for more information regarding these arrangements.

Investing in our securities involves a high degree of risk. Before buying our securities, you should consider carefully the risks described under the caption “Risk Factors” beginning on page S-7 of this prospectus and in the documents incorporated by reference in this prospectus and refer to the risk factors that may be included in a prospectus supplement and in our reports and other information that we file with the U.S. Securities and Exchange Commission.

Neither the U.S. Securities and Exchange Commission nor any state or Canadian securities commission or regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We expect to deliver the securities offered pursuant to this prospectus supplement on or about July 18, 2022.

Roth Capital Partners

The date of this prospectus supplement is July 13, 2022

PROSPECTUS SUPPLEMENT

|

Page |

||

|

S-ii |

||

|

S-iii |

||

|

S-1 |

||

|

S-7 |

||

|

S-9 |

||

|

S-10 |

||

|

S-11 |

||

|

S-12 |

||

|

S-13 |

||

|

S-15 |

||

|

S-18 |

||

|

S-18 |

||

|

S-18 |

||

|

S-18 |

||

|

S-19 |

PROSPECTUS

|

Page |

||

|

1 |

||

|

2 |

||

|

3 |

||

|

4 |

||

|

6 |

||

|

12 |

||

|

13 |

||

|

13 |

||

|

14 |

||

|

15 |

||

|

16 |

||

|

16 |

||

|

18 |

||

|

25 |

||

|

26 |

||

|

27 |

||

|

28 |

||

|

29 |

||

|

31 |

||

|

47 |

||

|

48 |

||

|

48 |

||

|

48 |

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is a supplement to the accompanying prospectus that is also a part of this document. This prospectus supplement and the accompanying prospectus, dated March 24, 2022, are part of a registration statement on Form F-3 (File No. 333-263834) that we filed with the Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process. Under this shelf registration process, we may offer and sell from time to time in one or more offerings the securities described in the accompanying prospectus.

This document is in two parts. The first part is this prospectus supplement, which describes the securities we are offering and the terms of the offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to the securities offered by this prospectus supplement. Generally, when we refer to this “prospectus,” we are referring to both documents combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference therein, on the other hand, you should rely on the information in this prospectus supplement. We urge you to carefully read this prospectus supplement and the accompanying prospectus and any related free writing prospectus, together with the information incorporated herein and therein by reference as described under the heading “Where You Can Find Additional Information,” before buying any of the securities being offered.

You should rely only on the information that we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus and any related free writing prospectus that we may authorize to be provided to you. We have not, and the Placement Agent has not, authorized anyone to provide you with different information. No other dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement and the accompanying prospectus or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any unauthorized information or representation. This prospectus supplement is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus supplement and the accompanying prospectus or any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or any related free writing prospectus, or any sale of a security.

This prospectus supplement contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

S-ii

This prospectus supplement, accompanying prospectus and the documents that we have filed with the SEC that are incorporated by reference in this prospectus supplement contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and may involve material risks, assumptions and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,” “should,” “believe,” “might,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” and similar words, although some forward-looking statements are expressed differently.

Any forward looking statements contained in this prospectus supplement, accompanying prospectus and the documents that we have filed with the SEC that are incorporated by reference in this prospectus supplement are only estimates or predictions of future events based on information currently available to our management and management’s current beliefs about the potential outcome of future events. Whether these future events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results, or financial condition will improve in future periods are subject to numerous risks. There are a number of important factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 20-F for the fiscal year ended December 31, 2021, as well as in our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus supplement and the accompanying prospectus. You should read these factors and the other cautionary statements made in this prospectus supplement, the accompanying prospectus and in the documents we incorporate by reference into this prospectus supplement and the accompanying prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus supplement or the documents we incorporate by reference into this prospectus supplement and the accompanying prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

S-iii

This summary is not complete and does not contain all of the information that you should consider before investing in the securities offered by this prospectus. You should read this summary together with the entire prospectus supplement and accompanying prospectus, including our risk factors (as provided for herein and incorporated by reference), financial statements, the notes to those financial statements and the other documents that are incorporated by reference in this prospectus supplement, before making an investment decision. You should carefully read the information described under the heading “Where You Can Find More Information.” We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities.

Overview

We offer a suite of proprietary software solutions for fan-engagement and rewards. We partner with a variety of content creators, from live event producers, professional sports franchises, video game publishers and developers, device manufacturers, and other interactive media content creators, like streamers, advertisers, ad agencies, as well as broadcast and OTT media companies. Our software gives all of our content partners the ability to offer first and second-screen interactivity that works in concert with their existing content to produce a more engaging entertainment offering for audiences. Content partners can pay us directly to provide these services, and we can also engage in a number of revenue-sharing opportunities with our partners as their content becomes more valuable to sponsors and advertisers.

Beyond the interactivity that results from our in-content and second screen games, like trivia, predictive, and branded casual-mobile games, we also offer a proprietary in-game prizing and rewards engine where players can win digital or real-world physical rewards for their gameplay. Based on the completion of in-content challenges, players can win a variety of prizes or rewards that can be tailored to each player or viewer based on a user-, context-, and content-based characteristics, including the player’s age or location, the game they played, the choices they made in game, or the challenge undertaken. Our platform facilitates several types of challenges and also a wide range of prize types, including coupons, sweepstakes-style prizes, consumer packaged goods (“CPG”), web3 prizes, and downloadable content (“DLC”).

With the acquisition of Xcite Interactive in June of 2021, we acquired a number of key pieces of technology, as well as relationships that continue to benefit our engagement and rewards business. First, we gained an industry-leading live events fan engagement business that partners with over 50 professional sports franchises across the National Football League (“NFL”), the National Basketball Association (“NBA”), the National Hockey League (“NHL”) and others to drive in-stadium audience engagement using interactive gaming functions like trivia, polling, and casual games that can be played alongside the live experience. Our three largest customers in 2021 included the Dallas Stars, New Jersey Devils and New York Jets. We also acquired a growing software licensing business that takes the in-venue fan engagement tools and methods developed by Xcite and its team over decades, productizing those tools in a scalable way that allows teams and content partners of all sizes to engage with fans in-venue and at home in measurable, effective ways at a fraction of the cost of a large professional game operations staff. The fan engagement platform, called eXtreme Engagement Online, or “XEO” is the centerpiece of the largest part of our in-venue sports business.

We license our XEO software platform to teams, leagues, and other content creators to create recurring revenue streams that supplement our professional services and advertising revenues. In addition to providing improved consumer engagement with games and features like trivia and polling, the XEO platform provides improved analytics and flexibility for our content partners through the real-time action board. The action board provides content partners with actionable insights during the game, and it also gives operators tools to adjust the run of show, reacting in real time to events that are happening on the field or in-venue, giving a more urgent, contextual feel to the content and making fan’s interactivity feel more authentic and personal. This real-time engagement tech, coupled with improved analytics about player behavior allows for both improved audience experience and also improved advertising efficiency.

S-1

We are able to provide our customers improved fan engagement, reaching out not only to those fans who are in the stadium, but also to those watching at home on television or streaming the game on a computer or mobile device. With XEO, alongside our other software offerings, fans can follow the game, interact with other fans, and compete for prizes and rewards offered by the team itself or by one of the team’s sponsors or branding partners. This engagement and rewards model can extend beyond professional sports to viewers of college sports, the Olympics, awards shows, reality TV, OTT services, physical venues, or streaming content on platforms like YouTube, Twitter, and Twitch. By driving second screen engagement, all of our content providers are able to maintain the consumer’s attention — even during lengthy commercials, timeouts, and breaks in play.

We believe our platform provides real benefits for three key target groups: content providers, brands and agencies, and fans/players. By providing interactivity and in-content rewards, content providers see more frequent sessions and longer session times from their users and viewers. Consumer brands offering sponsorships and in-content prizes or rewards within our interactive experiences see improved brand recall and brand affinity, as well as prolonged and increased interest from players and consumers who view their goods as a positive “win” within their viewing experience rather than as a distraction from the content they are watching as is typically the case with traditional in-content advertising. Players, viewers and consumers who interact alongside their favorite content, especially players who play for real-world rewards, show an increased desire to interact with such content, which increases the value of the content as a supplier of prizing opportunities, of the brands that offer the prizes, and of the experience itself as an interactive and desirable challenge for players and viewers.

We monetize prizes and sponsorships in a number of ways including Cost Per Click (“CPC”), Cost Per Action (“CPA”), and sponsorship revenues that can be charged to the brand. In those cases, we either are paid to place images within our interactive elements, or as a function of an end user interacting with the brand (CPC), or as a function of the user accepting the reward or in some way transacting with the brand (CPA). We share a certain percentage of the gross receipts we receive from such brand customers with the content partners who are the owners of the media in which the prizes or rewards are offered. Our current agreements with the owners or marketers of consumer brands provide that we are paid a fee to place their ads in content, the amount of which is based either on the number of ads placed or upon the performance of those ads relative to the brand’s goals.

Our revenues have principally come from software licensing and professional services provided to professional sports franchises as well as fan engagement events like rodeos, boxing matches, concerts, and other live events including the Olympics, Women’s World Cup, the X Games, and other global sporting events. Our current agreements with content or game owners can provide for any or all of three types of revenues to us: software license fees, professional service fees, and engagement-based advertising fees. Our software license and professional service fees are most common in our contracts.

According to a 2018 study by us and the University of California, Los Angeles Center for Management of Enterprise in Media, Entertainment and Sports, the introduction of rewards benefits content providers, brands, and players across a variety of demographics.

Our technology facilitates advertising that is part of the entertainment itself — part of the narrative, not as a distraction. By creating an environment that makes brands part of a desired experience — winning prizes or rewards — we empower content providers and brands to engage consumers more effectively and for more extended periods of time.

S-2

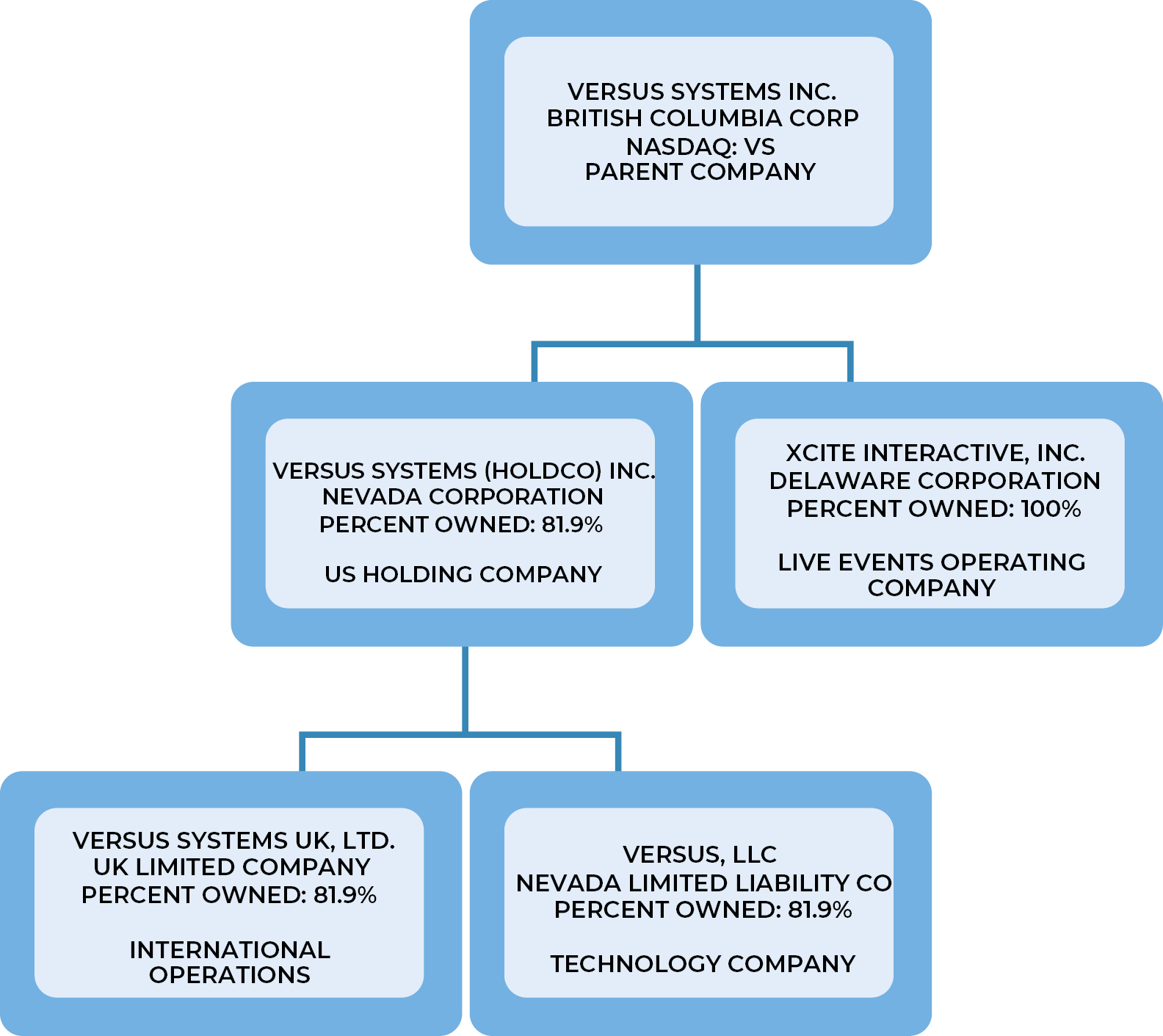

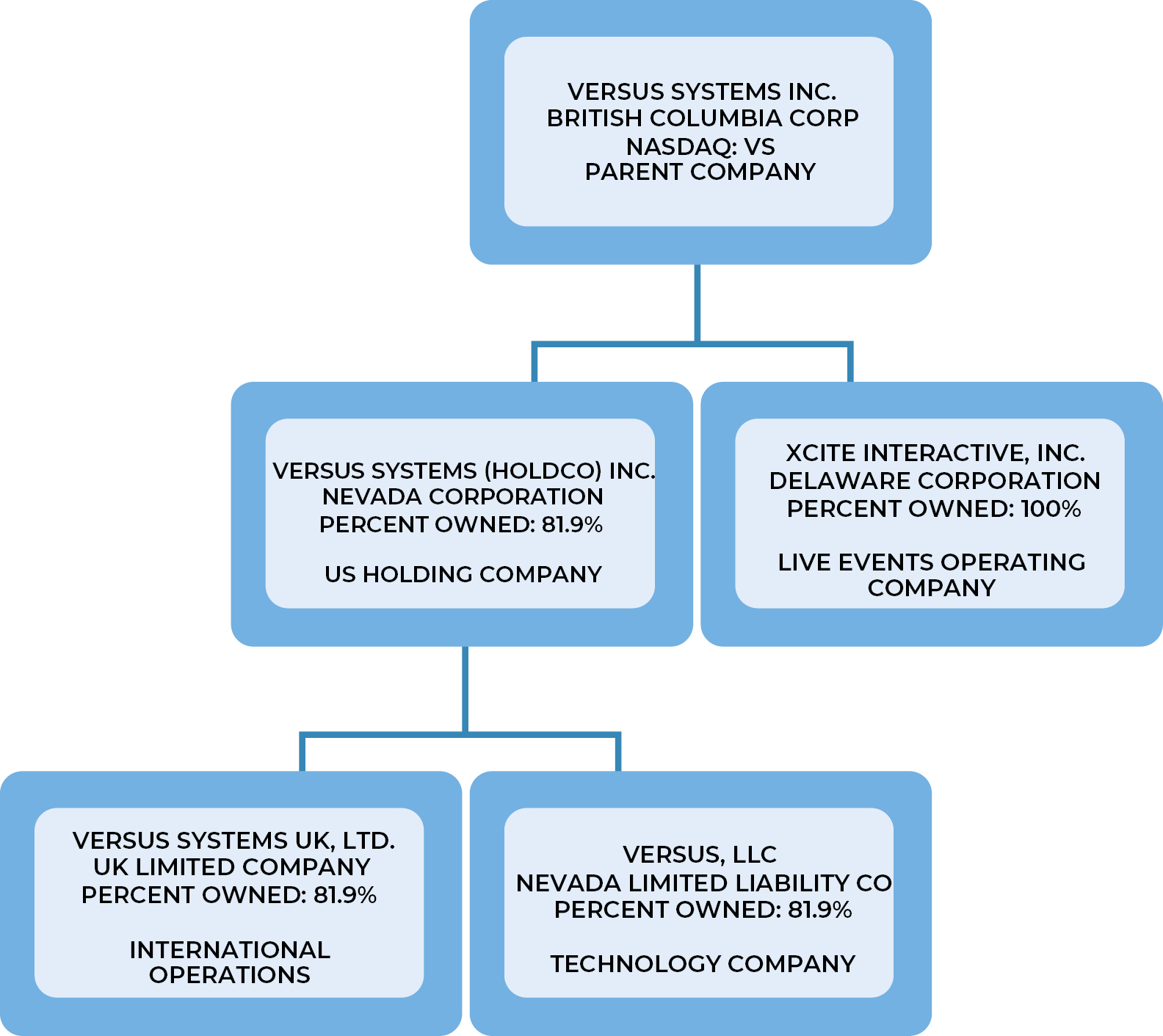

Corporate Structure

Recent Developments

Master Services Agreement with Innovative Group, LLC.

On June 7, 2022, we entered into a strategic partnership with experiential and digital marketing agency Innovative Group to support new client programs built upon the Versus XEO platform.

Master Services Agreement with Diplomat Sports & Entertainment Inc.

On March 24, 2022, we entered into a Master Services Agreement with Diplomat Sports & Entertainment, Inc, a Tokyo-based advertising agency, to power interactive fan experiences for the Hokkaido Nippon-Ham Fighters of Nippon Professional Baseball.

Master Services Agreement with ENT Marketing Inc.

On February 17, 2022, we entered into a Master Services Agreement with ENT Marketing Inc., a branded entertainment agency, to support new client activations that employ the Versus XEO platform for fan engagement and rewards. The first collaboration was a marketing promotion for a popular fast-casual chicken restaurant chain, which represented the first use of the XEO platform in a quick-service restaurant activation.

Master Services Agreement with Red Moon Marketing, LLC

On February 4, 2022, we entered into a Master Services Agreement with Red Moon Marketing, LLC, a marketing agency, to support new client activations that employ the Versus XEO platform for fan engagement and rewards. We intend to support Red Moon’s portfolio of clients, which include consumer packaged goods, retailers, and spirits.

S-3

Master Services Agreements with Prizing

On January 20, 2022 and January 25, 2022, we entered into a Master Services Agreements with San Antonio Rodeo and NASCAR, respectively. Pursuant to these agreements, we will be paid based upon usage, rather than based upon a percentage of advertising revenue, related to the use of the Company’s platform.

Corporate Information

Versus Systems Inc., a corporation formed under the laws of British Columbia, was formed by way of an amalgamation under the name McAdam Resources, Inc. in the Province of Ontario on December 1, 1988 and subsequently extra-provincially registered in British Columbia on February 2, 1989. We changed our name to Boulder Mining Corporation on May 9, 1995 in Ontario and on September 25, 1996 in British Columbia. We continued into British Columbia on January 2, 2007 and concurrently changed our name to Opal Energy Corp. We changed our name to Versus Systems Inc. on June 30, 2016, and concurrently ceased or divested our mining related business and began operating our current software platform business.

In June 2021, we completed the acquisition of multimedia, production, and interactive gaming company Xcite Interactive, a provider of online audience engagement through its owned and operated XEO technology platform. We now provide products and services to multiple professional sports franchises across MLB, the NHL, the NBA and the NFL to drive in-stadium audience engagement as well as a software licensing business to drive audience engagement.

We operate through our majority-owned subsidiary, Versus LLC, a Nevada limited liability company that was organized on August 21, 2013, and through our wholly-owned subsidiary, Xcite Interactive Inc, a Delaware company that was reorganized as such on April 1, 2019.

Our principal executive offices in Canada are located at 1558 Hastings Street, Vancouver, British Columbia V6G 3J4 Canada, and our telephone number is (604) 639-4457. Our principal executive offices in the United States are located at 6701 Center Drive West, Suite 480, Los Angeles, CA 90045, and our telephone number at that address is (424) 226-8588. Our website address is www.versussystems.com. The information on or accessed through our website is not incorporated in this prospectus. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issues that file electronically with the SEC.

S-4

The Offering

|

Issuer: |

Versus Systems Inc. |

|

|

Common shares offered by us: |

2,100,000 shares |

|

|

Price per common share |

$0.52 |

|

|

Pre-funded Warrants offered by us |

Pre-funded Warrants to purchase up to 2,045,000 common shares. Each Pre-funded Warrant will be exercisable for one of our common shares. The purchase price of each Pre-funded Warrant will equal the price per share at which the common shares are being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-funded Warrant will be $0.0001 per share. This offering also relates to the common shares issuable upon exercise of any Pre-funded Warrants sold in this offering. The exercise price and number of common shares issuable upon exercise will be subject to certain further adjustments as described herein. See “Description of Securities Offered” on page S-13 of this prospectus supplement. |

|

|

Concurrent Private Placement of Common Warrants |

|

|

|

Common shares to be outstanding after this offering: |

|

|

|

Use of proceeds: |

We intend to use the net proceeds from this offering solely for working capital and other general corporate purposes. There is no assurance that any of the warrants offered hereby will ever be exercised for cash, if at all. See “Use of Proceeds” on page S-10. |

|

|

Lock-up: |

We have agreed, subject to certain exceptions, not to sell, offer or otherwise dispose of or transfer, directly or indirectly, any of our capital stock (including common shares) or any securities convertible into or exchangeable for our capital stock, during a period commencing on the date of this prospectus supplement and ending 30 days after the closing of this offering, without the prior consent of the Placement Agent. See “Plan of Distribution” in this prospectus supplement. |

S-5

|

Risk factors: |

You should read the “Risk Factors” section beginning on page S-7 of this prospectus supplement, the “Risk Factors” section beginning on page 12 of the accompanying prospectus, and the “Risk Factors” section in our Annual Report on Form 20-F for the year ended December 31, 2021 for a discussion of factors to consider before deciding to purchase our securities. |

|

|

Market for the shares and warrants: |

Our common shares are quoted and traded on the NASDAQ Capital Market under the symbol “VS.” However, there is no established public trading market for the Pre-funded Warrants, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-funded Warrants on any securities exchange. |

The 24,899,424 common shares to be outstanding after this offering is based on 20,691,488 shares outstanding as of March 31, 2022, plus (i) 62,936 common shares issued subsequent to March 31, 2022, (ii) the 2,100,000 common shares offered hereby and (iii) the 2,045,000 Pre-funded Warrants offered hereby. The 24,899,424 common shares to be outstanding after this offering, assuming the exercise of the Pre-funded Warrants in full, excludes the following:

• 7,436,747 common shares issuable upon exercise of outstanding warrants at March 31, 2022 with a weighted average exercise price of $2.21 per share;

• 1,951,206 common shares reserved for issuance upon the exercise of outstanding stock options at March 31, 2022 with a weighted average exercise price of $4.20 per share issued pursuant to our 2017 Stock Option Plan;

• 331,600 common shares issuable upon exercise of warrants to be issued to the Placement Agent in connection with this offering;

• 6,217,500 common shares issuable upon the exercise of warrants to be sold in a concurrent private placement; and

• 137,941 common shares issuable upon conversion of outstanding Versus Systems (Holdco) shares.

Unless otherwise stated, outstanding share information throughout this prospectus supplement excludes the above.

S-6

Before you make a decision to invest in our securities, you should consider carefully the risks described below, together with other information in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein. If any of the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our common shares to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business operations and could result in a complete loss of your investment.

You should also carefully consider the risk factors set forth under “Risk Factors” described in our annual report on Form 20-F for the fiscal year ended December 31, 2021, together with all other information contained or incorporated by reference in this prospectus supplement and in any related free writing prospectus in connection with a specific offering, before making an investment decision.

Risks Related to Our Securities and the Offering

If you purchase the common shares, you will experience immediate dilution as a result of this offering.

Since the price per share of our common shares being offered is substantially higher than the net tangible book value per share of our common shares, you will suffer immediate and substantial dilution in the net tangible book value of the common shares you purchase in this offering or the common shares underlying the Pre-funded Warrants you purchase in this offering. After giving effect to the sale by us of (i) 2,100,000 our common shares at the offering price of $0.52 per common share and (ii) 2,045,000 Pre-funded Warrants at the offering price of $0.5199 per Pre-funded Warrant, if you purchase common shares in this offering, you will suffer immediate and substantial dilution of approximately $0.35 per share in the net tangible book value of the common shares. See the section entitled “Dilution” in this prospectus supplement for a more detailed discussion of the dilution you will incur if you purchase common shares in this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common shares or other securities convertible into or exchangeable for our common shares that could result in further dilution to the investor purchasing our common shares in this offering or result in downward pressure on the price of our common shares. We may sell our common shares or other securities in any other offering at prices that are higher or lower than the prices paid by the investor in this offering, and the investor purchasing shares or other securities in the future could have rights superior to existing shareholders. Moreover, to the extent that we issue options or warrants to purchase, or securities convertible into or exchangeable for, our common shares in the future and those options, warrants or other securities are exercised, converted or exchanged, stockholders may experience further dilution.

The trading price of our common shares has been, and is likely to continue to be highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control.

Our share price is volatile. During the period from January 1, 2022 to July 13, 2022, the closing price of our common shares ranged from a high of $2.43 per share to a low of $0.41 per share. The stock market in general has experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may not be able to sell your common shares at or above the public offering price and you may lose some or all of your investment.

There is no public market for the Pre-funded Warrants being offered in this offering.

There is no established public trading market for the Pre-funded Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-funded Warrants on any securities exchange or nationally recognized trading system, including Nasdaq. Without an active market, the liquidity of the Pre-funded Warrants will be limited.

S-7

Holders of Pre-funded Warrants purchased in this offering will have no rights as common shareholders until such holders exercise their Pre-funded Warrants and acquire our common shares, except as otherwise provided in the Pre-funded Warrants.

Until holders of Pre-funded Warrants acquire shares of our common shares upon exercise of such warrants, holders of Pre-funded Warrants will have no rights with respect to our common shares underlying such Pre-funded Warrants. Upon exercise of the Pre-funded Warrants, the holders will be entitled to exercise the rights of a common shareholder only as to matters for which the record date occurs after the exercise date.

Our management will have broad discretion over the use of the proceeds we receive from the sale our securities pursuant to this prospectus and might not apply the proceeds in ways that increase the value of your investment.

Our management will have broad discretion to use the net proceeds from the offering, and you will be relying on the judgment of our management regarding the application of these proceeds. Except as described in any prospectus supplement or in any related free writing prospectus that we may authorize to be provided to you, the net proceeds received by us from our sale of the securities described in this prospectus will be added to our general funds and will be used for general corporate purposes. Our management might not apply the net proceeds from offerings of our securities in ways that increase the value of your investment and might not be able to yield a significant return, if any, on any investment of such net proceeds. You may not have the opportunity to influence our decisions on how to use such proceeds.

S-8

In a concurrent private placement, we are selling to the investor in this offering Series C common share purchase warrants to purchase up to an aggregate of 6,217,500 common shares (the “Common Warrants”). The Common Warrants are exercisable at an exercise price of $0.52 per share, subject to certain adjustments, are exercisable immediately following the closing date of this offering and have a term of exercise equal to five and a half years from the date of their initial exercisability. A holder of Common Warrants will have the right to exercise the Common Warrants on a “cashless” basis if there is no effective registration statement registering the resale of the common shares underlying the Common Warrant (the “Common Warrants Shares”). Subject to limited exceptions, a holder of Common Warrants will not have the right to exercise any portion of its Common Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or 9.99% at the election of the holder prior to the date of issuance) of the number of our common shares outstanding immediately after giving effect to such exercise, provided that the holder may increase or decrease the beneficial ownership limitation up to 9.99%. Any increase in the beneficial ownership limitation shall not be effective until 61 days following notice of such change to us.

Except as otherwise provided in the Common Warrants or by virtue of such holder’s ownership of our common shares, the holders of the Common Warrants do not have the rights or privileges of holders of our common shares, including any voting rights, until they exercise their Common Warrants.

The Common Warrants and the Common Warrant Shares are being offered pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder, and are not being offered pursuant to this prospectus supplement and the accompanying prospectus.

In the event of any fundamental transaction, as described in the Common Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our common shares, then upon any subsequent exercise of a Common Warrant, the holder will have the right to receive as alternative consideration, for each common share that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of common shares of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of common shares for which the Common Warrant is exercisable immediately prior to such event. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the Common Warrants have the right to require us or a successor entity to redeem the Common Warrants for cash in the amount of the Black Scholes Value (as defined in each Common Warrant) of the unexercised portion of the Common Warrants concurrently with or within 30 days following the consummation of a fundamental transaction. However, in the event of a fundamental transaction which is not in our control, including a fundamental transaction not approved by our board of directors, the holders of the Common Warrants will only be entitled to receive from us or our successor entity, as of the date of consummation of such fundamental transaction the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Common Warrant, that is being offered and paid to the holders of our common shares in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination of cash and stock, or whether the holders of our common shares are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

There is no established public trading market for the Common Warrants and we do not expect a market to develop. In addition, we do not intend to list the Common Warrants on the Nasdaq Capital Market, any other national securities exchange or any other nationally recognized trading system.

S-9

We estimate that the net proceeds we will receive from the sale of our common shares and the Pre-funded Warrants in this offering will be approximately $1,932,779.86, after deducting estimated offering expenses of approximately $50,000 and Placement Agent fees. These estimates exclude the proceeds, if any, from the exercise of the Pre-funded Warrants sold in this offering, the Common Warrants sold in a private placement concurrently with this offering or the warrants issued to the Placement Agent.

If all of the Pre-funded Warrants sold in this offering, the Common Warrants sold in a private placement concurrently with this offering and the warrants issued to the Placement Agent are exercised in full for cash, we would receive additional aggregate proceeds of approximately $3,405,737.

We intend to use the net proceeds from this offering for general corporate purposes and working capital, including for marketing and sales, research and development and general and administrative expenses.

We have not specifically identified the precise amounts we will spend on each of these areas or the timing of these expenditures. The amounts actually expended for each purpose may vary significantly depending upon numerous factors, including assessments of potential market opportunities and competitive developments. In addition, expenditures may also depend on the establishment of new collaborative arrangements with other companies, the availability of other financing, and other factors. Our management will have discretion in the application of the net proceeds from this offering. Our shareholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for purposes that may not result in our being profitable or increase our market value.

S-10

If you purchase any of the common shares offered by this prospectus supplement, you will experience dilution to the extent of the difference between the offering price per common share you pay in this offering and the net tangible book value per common share immediately after this offering. Our audited net tangible book value as of March 31, 2022 was approximately $2.2 million, or approximately $0.11 per common share. Net tangible book value per share is equal to our total tangible assets minus total liabilities, divided by the number of common shares outstanding.

After giving effect to the sale by us in this offering of 2,100,000 common shares at a public offering price of $0.52 per common share and 2,045,000 Pre-funded Warrants at a public offering price of $0.5199 per Pre-funded Warrant, and after deducting estimated offering expenses payable by us, our as adjusted net tangible book value as of March 31, 2022 would have been approximately $4.2 million, or approximately $0.17 per common share. This represents an immediate increase in net tangible book value of approximately $0.06 per share to existing shareholders and an immediate dilution of approximately $0.35 per share to new investors. Our net tangible book value calculation assumes no exercise of the Pre-funded Warrants offered hereby. The following table illustrates this calculation on a per share basis:

|

Public offering price per common share |

|

$ |

0.52 |

|||

|

Net tangible book value per share as of March 31, 2022 |

$ |

0.11 |

|

|||

|

Increase in adjusted net tangible book value per share attributed to the |

|

0.06 |

|

|||

|

Net tangible book value per share after giving effect to this offering |

|

|

0.17 |

|||

|

Dilution to net tangible book value per share to new investors purchasing |

|

$ |

0.35 |

To the extent that our outstanding options, warrants or subscription investment units are exercised, investors in this offering may suffer additional dilution.

The total number of common shares reflected in the discussion and table above is based on 20,691,488 shares outstanding as of March 31, 2022, plus (i) 62,936 common shares issued subsequent to March 31, 2022, (ii) 2,100,000 common shares offered hereby, and (iii) 2,045,000 Pre-funded Warrants offered hereby. The 24,899,424 common shares to be outstanding after this offering, assuming exercise in full of the Pre-funded Warrants, excludes the following:

• 7,436,747 common shares issuable upon exercise of outstanding warrants at March 31, 2022 with a weighted average exercise price of $2.21 per share;

• 1,951,206 common shares reserved for issuance upon the exercise of outstanding stock options at March 31, 2022 with a weighted average exercise price of $4.20 per share issued pursuant to our 2017 Stock Option Plan;

• 331,600 common shares issuable upon exercise of warrants to be issued to the Placement Agent in connection with this offering;

• 6,217,500 common shares issuable upon exercise of warrants to be sold in a concurrent private placement; and

• 137,941 common shares issuable upon conversion of outstanding Versus Systems (Holdco) shares.

S-11

The following table sets forth our capitalization as of March 31, 2022:

• on an actual basis; and

• on a pro forma as adjusted basis to give effect to the sale by us of (i) 2,100,000 common shares in this offering at the public offering price of $0.52 per share, (ii) 2,045,000 Pre-funded Warrants at the public offering price of $0.5199 per Pre-funded Warrant, and reflects the application of the net proceeds of such sales after deducting the 8% Placement Agent fee and approximately $50,000 of estimated offering expenses payable by us.

You should read this table in conjunction with our financial statements and notes thereto included in this prospectus, and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

As of March 31, 2022 |

||||||||

|

Actual |

Adjusted |

|||||||

|

Cash and cash equivalents |

$ |

5,358,646 |

|

$ |

7,291,426 |

|

||

|

Liabilities: |

|

|

|

|

||||

|

Warrant liability |

|

133,058 |

|

|

133,058 |

|

||

|

Notes payable |

|

2,790,987 |

|

|

2,790,987 |

|

||

|

Total liabilities |

|

4,132,302 |

|

|

4,132,302 |

|

||

|

Equity |

|

|

|

|

||||

|

Share capital |

|

|

|

|

||||

|

Common shares, no par value; unlimited shares authorized and 20,691,488 shares issued and outstanding on an actual basis, 24,899,424 shares issued and outstanding on a pro forma basis |

|

117,389,249 |

|

|

119,322,029 |

|

||

|

Commitment to issue shares; |

|

2,703,326 |

|

|

2,703,326 |

|

||

|

Class A shares; 5,057 shares authorized and 5,057 issued and outstanding on an actual and on a pro forma and a pro forma as adjusted basis |

|

28,247 |

|

|

28,247 |

|

||

|

Reserves |

|

11,169,697 |

|

|

11,169,697 |

|

||

|

Deficit |

|

(108,139,866 |

) |

|

(108,139,866 |

) |

||

|

Total equity before non-controlling interest |

|

23,150,653 |

|

|

25,083,433 |

|

||

|

Non-controlling interest |

|

(5,018,761 |

) |

|

(5,081,761 |

) |

||

|

Total equity |

|

18,131,892 |

|

|

20,064,672 |

|

||

|

Total liabilities and equity |

$ |

22,264,194 |

|

$ |

24,196,974 |

|

||

S-12

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

In this offering, we are offering 2,100,000 common shares at a purchase price of $0.52 per share and Pre-funded Warrants to purchase an additional 2,045,000 common shares at a purchase price of $0.5199 per Pre-funded Warrant.

Common Shares

A description of the common shares that we are offering pursuant to this prospectus supplement is set forth under the heading “Description of Share Capital — Common Shares,” starting on page 16 of the accompanying prospectus. As of June 30, 2022, we had 20,754,424 outstanding common shares.

Pre-funded Warrants

The material terms and provisions of the Pre-funded Warrants being offered pursuant to this prospectus supplement and the accompanying prospectus are summarized below. The summary is subject to, and qualified in its entirety by, the form of Pre-funded Warrant which will be provided to each investor in this offering and will be filed as an exhibit to a Report on Form 6-K with the SEC in connection with this offering.

Duration and Exercise Price. Each Pre-funded Warrant offered hereby has an initial exercise price per share equal to $0.0001. The Pre-funded Warrants are immediately exercisable and will expire when exercised in full. The exercise price and number of common shares issuable upon exercise is subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our common shares and the exercise price.

Exercisability. The Pre-funded Warrants are exercisable immediately upon issuance and have no exercise date. The Pre-funded Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and payment in full in immediately available funds for the number of common shares purchased upon such exercise.

Exercise Limitation. A holder will not have the right to exercise any portion of the Pre-funded Warrants if the holder (together with its affiliates and any other persons acting as a group together with the holder or any of the holder’s affiliates) would beneficially own in excess of 4.99% (or, upon election of the holder, 9.99%) of the number of our common shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-funded Warrants. Any holder may increase or decrease such percentage, but in no event may such percentage be increased to more than 9.99%, provided that any increase will not be effective until the 61st day after such election.

Cashless Exercise. In lieu of making the cash payment otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of shares of common shares determined according to a formula set forth in the Pre-funded Warrants.

Fundamental Transactions. In the event of any fundamental transaction, as described in the Pre-funded Warrants and generally including any merger with or into another entity, sale of all or substantially all of our assets, tender offer or exchange offer, or reclassification of our common shares, then upon any subsequent exercise of a Pre-funded Warrant, the holder will have the right to receive as alternative consideration, for each common share that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental transaction, the number of common shares of the successor or acquiring corporation of our company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of common shares for which the Pre-funded Warrant is exercisable immediately prior to such event. Notwithstanding the foregoing, in the event of a fundamental transaction, the holders of the Pre-funded Warrants have the right to require us or a successor entity to redeem the Pre-funded Warrants for cash in the amount of the Black Scholes Value (as defined in each Pre-funded Warrant) of the unexercised portion of the Pre-funded Warrants concurrently with or within 30 days following the consummation of a fundamental transaction. However, in the event of a fundamental transaction which is not in our control, including a fundamental transaction not approved by our board of directors, the holders of the Pre-funded Warrants will only be entitled to receive from us or our successor entity, as of the date of consummation of such fundamental transaction the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Pre-funded Warrant, that is being offered and paid to the holders of

S-13

our common shares in connection with the fundamental transaction, whether that consideration is in the form of cash, stock or any combination of cash and stock, or whether the holders of our common shares are given the choice to receive alternative forms of consideration in connection with the fundamental transaction.

Transferability. Subject to applicable laws, a Pre-funded Warrant may be transferred at the option of the holder upon surrender of the Pre-funded Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer taxes (if applicable).

Exchange Listing. There is no established trading market for the Pre-funded Warrants. We do not intend to list the Pre-funded Warrants on any securities exchange or nationally recognized trading system.

Right as a Shareholder. Except as otherwise provided in the Pre-funded Warrants or by virtue of such holder’s ownership of our common shares, the holders of the Pre-funded Warrants do not have the rights or privileges of holders of our common shares, including any voting rights, until such Pre-funded Warrant holders exercise their Pre-funded Warrants.

S-14

Roth Capital Partners, LLC, referred to herein as Roth or the placement agent, has agreed to act as our sole placement agent in connection with this offering subject to the terms and conditions of a placement agency agreement, dated July 13, 2022 by and between Roth Capital Partners, LLC and us. The placement agent is not purchasing or selling any securities offered by this prospectus supplement and the accompanying base prospectus but has arranged for the sale of certain of the securities offered hereby through a securities purchase agreement entered into between the investor and us. The public offering price of the common shares and/or the Pre-funded Warrants offered by this prospectus supplement and the accompanying base prospectus has been determined based upon arm’s-length negotiations between the investor and us.

We have entered into a securities purchase agreement directly with the investor in this offering on July 13, 2022 (the “Securities Purchase Agreement”). A form of the Securities Purchase Agreement will be included as an exhibit to our Report of Foreign Private Issuer on Form 6-K to be filed with the SEC in connection with this offering. The Securities Purchase Agreement provides such investor with certain representations, warranties and covenants, including indemnifications, from us. Our obligation to issue and sell the securities to the investor who is party to the Securities Purchase Agreement is subject to the closing conditions set forth therein, including the absence of any material adverse change in our business and the receipt of certain opinions, letters and certificates from us or our counsel, which may be waived by the respective parties. All of the securities will be sold at the offering price specified in this prospectus supplement and, we expect, at a single closing.

Commissions and Expenses

We have agreed to pay the placement agent an aggregate cash placement fee equal to 8.0% of the gross proceeds in this offering from sales arranged for by the placement agent. Subject to certain conditions, we also have agreed to reimburse all reasonable travel and other out-of-pocket expenses of the placement agent in connection with this offering, including but not limited to the reasonable fees of legal counsel, not to exceed $50,000.

We currently anticipate that the delivery of the shares will occur on or about July 18, 2022. At the closing, The Depository Trust Company will credit the common shares to the account of the investor or the transfer agent will issue the shares to the investor in book-entry form, as elected by the investor in the purchase agreement.

Other Terms

Under the Securities Purchase Agreement, and subject to certain exceptions, we have agreed not to (i) enter into any agreement to issue or announce the issuance or proposed issuance of any common shares or common share equivalents, or (ii) file any registration statement or amendment or supplement thereto, subject to certain exceptions, for a period of thirty (30) days following the closing of the offering. We have also agreed not to effect or enter into an agreement to effect any issuance of common share or common share equivalents involving a Variable Rate Transaction, as defined in the Securities Purchase Agreement, or “at-the-market offering,” from the closing of the offering until six (6) months from the closing of the offering.

Lock-Up Agreements.

In connection with this offering, each of our executive officers and directors has agreed, subject to certain exceptions set forth in the lock-up agreements, not to sell, offer, agree to sell, contract to sell, hypothecate, pledge, grant any option to purchase, make any short sale of, or otherwise dispose of, directly or indirectly, any of our common shares, or any securities convertible into or exercisable or exchangeable for our common shares, for 30 days following the closing of the offering. The purchaser may, in its sole discretion and without notice, waive the terms of the lock-up agreement.

Determination of Offering Price

The public offering price of the securities we are offering was negotiated between us and the investor, in consultation with the placement agent based on the trading of our common shares prior to the offering, among other things. Other factors considered in determining the public offering price of our securities we are offering include our

S-15

history and prospects, the stage of development of our business, our business plans for the future and the extent to which they have been implemented, an assessment of our management, general conditions of the securities markets at the time of the offering and such other factors as were deemed relevant.

Regulation M Restrictions

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of any shares of common shares sold by it while acting as a principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities Act and the Exchange Act including Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M promulgated under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares offered hereby by the placement agent acting as a principal. Under these rules and regulations, the placement agent:

• must not engage in any stabilization activity in connection with our securities; and

• must not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

Passive Market Making

In connection with this offering, the placement agent may engage in passive market making transactions in our common shares on the Nasdaq Stock Market in accordance with Rule 103 of Regulation M promulgated under the Exchange Act during a period before the commencement of offers or sales of our common shares and extending through the completion of the distribution. A passive market maker must display its bid at a price not in excess of the highest independent bid of that security. If all independent bids are lowered below the passive market maker’s bid, however, that bid must then be lowered when specified purchase limits are exceeded.

Right of First Refusal

In addition, if at any time during the six (6) months following the date of the expiration or termination of the engagement agreement, we propose to make a private placement or public offering of equity, equity-linked or debt securities or pursue a merger or acquisition using an agent, we must offer the placement agent an opportunity to act as the exclusive agent placement agent or lead underwriter, subject to certain conditions.

Tail

In the event that any investor whom the placement agent had contacted during the term of its engagement or introduced to the Company during the term of the engagement of the placement agent, subject to certain exceptions, provides any capital to us in a public or private offering or capital-raising transaction, within the three (3) months following the expiration or termination of the engagement of the placement agent, we shall pay the placement agent a cash fee in the amount that would otherwise have been payable to the placement agent had such transaction occurred during the term.

Indemnification

We have agreed to indemnify the placement agent against certain liabilities, including liabilities under the Securities Act, and liabilities arising from breaches of representations and warranties contained in the placement agency agreement, or to contribute to payments that the placement agent may be required to make in respect of those liabilities.

Other Relationships

The placement agent and its affiliates may in the future engage in investment banking transactions and other commercial dealings in the ordinary course of business with us or our affiliates. The placement agent has received, or may in the future receive, customary fees and commissions for these transactions.

S-16

Electronic Distribution

This prospectus supplement and the accompanying base prospectus may be made available in electronic format on websites or through other online services maintained by the placement agent or by an affiliate. Other than this prospectus supplement and the accompanying base prospectus, the information on the placement agent’s website and any information contained in any other website maintained by the placement agent is not part of this prospectus supplement and the accompanying base prospectus or the registration statement of which this prospectus supplement and the accompanying base prospectus forms a part, has not been approved and/or endorsed by us or the placement agent, and should not be relied upon by investors.

S-17

Certain legal matters in connection with the securities offered hereby will be passed upon on behalf of the Company by Pryor Cashman LLP, New York, New York, with respect to U.S. legal matters and by Fasken Martineau DuMoulin LLP, Vancouver, Canada, with respect to Canadian legal matters. Ellenoff Grossman & Schole LLP, New York, New York, is acting as counsel for the Placement Agent in this offering.

Our audited consolidated financial statements as of and for the year ended December 31, 2021 included in this prospectus have been so included in reliance upon the report of Ramirez Jimenez International CPAs, independent registered public accountants, upon the authority of the said firm as experts in accounting and auditing.

Our audited consolidated financial statements as of and for the years ended December 31, 2020 and 2019 included in this prospectus have been so included in reliance upon the report of Davidson & Company LLP, independent registered public accountants, upon the authority of the said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form F-3 under the Securities Act with respect to the securities we are offering under this prospectus supplement. This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the registration statement and the exhibits to the registration statement.

For further information with respect to us and the securities we are offering under this prospectus supplement, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. Statements contained in this prospectus supplement as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference. We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http:/www.sec.gov. You may also read and copy any document we file at the SEC’s public reference room, 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Because our common shares are listed on the NASDAQ Capital Market, you may also inspect reports, proxy statements and other information at the offices of the NASDAQ Capital Market. Information found on our website is not part of this prospectus supplement or any other report we file with or furnish to the Securities and Exchange Commission.

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of our company pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by our company of expenses incurred or paid by a director, officer or controlling person of our company in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the common shares being offered hereunder, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

S-18

IMPORTANT INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information we have filed with the SEC into this prospectus. This means that we can disclose important information to you by referring to another document filed separately with the SEC. The information incorporated by reference is an important part of this prospectus, and the information we file subsequently with the SEC will automatically update and supersede the information in this prospectus. The information that we incorporate by reference in this prospectus is deemed to be a part of this prospectus. This prospectus incorporates by reference the documents listed below that we have previously filed with the SEC:

• Our Annual Report on Form 20-F for the year ended December 31, 2021, filed with the SEC on April 1, 2022;

• Our Reports on Form 6-K furnished to the SEC on April 4, 2022 and May 17, 2022; and

• The description of our common shares contained in our Registration Statement on Form F-1 filed with the SEC on November 20, 2020 and any amendments thereto filed to update the description.

In addition, this prospectus shall also be deemed to incorporate by reference all subsequent annual reports filed on Form 20-F, Form 40-F or Form 10-K, and all subsequent filings on Forms 10-Q and 8-K (if any) filed by us pursuant to the U.S. Exchange Act prior to the termination of the offering made by this prospectus. We may also incorporate by reference into this prospectus any Form 6-K that is submitted to the SEC after the date of the filing of the registration statement of which this Prospectus forms a part and before the date of termination of this offering. Any such Form 6-K that we intend to so incorporate shall state in such form that it is being incorporated by reference into this prospectus. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to us, and you should review all information contained in this prospectus and the documents incorporated or deemed to be incorporated herein by reference.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus, to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this prospectus, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Documents which we incorporate by reference are available from us without charge, excluding all exhibits, unless we have specifically incorporated by reference an exhibit in this prospectus. You may obtain documents incorporated by reference in this prospectus by requesting them in writing or by telephone from us at:

Versus Systems Inc.

Attention: Corporate Secretary

6701 Center Drive West, Suite 480

Los Angeles, CA 90045

(310) 242-0228

Statements contained in this prospectus supplement as to the contents of any contract or other documents are not necessarily complete, and in each instance you are referred to the copy of the contract or other document filed as an exhibit to the registration statement or incorporated herein, each such statement being qualified in all respects by such reference and the exhibits and schedules thereto.

S-19

PROSPECTUS

Versus Systems Inc.

$25,000,000

Common Shares

Debt Securities

Subscription Receipts

Warrants

Rights

Units

__________________________

Versus Systems Inc. may offer, issue and sell, from time to time, in one or more offerings, the securities described in this prospectus. We may also offer securities of the types listed above that are convertible or exchangeable into one or more of the securities so listed. The total aggregate offering price for these securities will not exceed $25,000,000 (or the equivalent thereof in other currencies).

These securities may be offered or sold to or through one or more underwriters, dealers or agents, or directly to purchasers, on a continued or delayed basis. We will provide the names of any such agents and underwriters used in connection with the sale of any of these securities, as well as any fees, commissions or discounts we may pay to such agents and/or underwriters in connection with the sale of these securities, in the applicable prospectus supplement.

This prospectus describes the general terms of these securities and the general manner in which we will offer them. We will provide the specific terms of these securities, and the manner in which they are being offered, in supplements to this prospectus. You should read this prospectus, any post-effective amendment and the applicable prospectus supplement, as well as any documents we have incorporated into this prospectus by reference carefully before you invest. Where required by statute, regulation or policy, and where securities are offered in currencies other than United States dollars, appropriate disclosure of foreign exchange rates applicable to the securities will be included in the prospectus supplement describing the securities. This prospectus does not qualify in any of the provinces or territories of Canada the distribution of the securities to which it relates.

The aggregate market value of our outstanding common shares held by non-affiliates is $20.8 million based on 20,100,863 common shares outstanding as of March 22, 2022, of which 15,627,113 common shares are held by non-affiliates, at a price per common share of $1.33 based on the closing sale price of our common shares on the NASDAQ Capital Market on March 22, 2022. In addition, as of the date hereof, we have not offered any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

Our principal executive offices in Canada are located at 1558 Hastings Street, Vancouver, British Columbia V6G 3J4 Canada, and our telephone number is (604) 639-4457. Our principal executive offices in the United States are located at 6701 Center Drive West, Suite 480, Los Angeles, CA 90045, and our telephone number at that address is (424) 226-8588.

The common shares of Versus Systems Inc. are listed on the NASDAQ Capital Market under the symbol “VS.” On March 22, 2022, the closing price of our common shares on the NASDAQ Capital Market was $1.33 per share. There is currently no market through which the securities, other than the common shares, may be sold and purchasers may not be able to resell the securities purchased under this prospectus. This may affect the pricing of the securities in the secondary market, the transparency and availability of trading prices, the liquidity of the securities and the extent of issuer regulation. See “Risk Factors”.

__________________________

Investing in our securities involves a high degree of risk. Before buying our securities, you should consider carefully the risks described under the caption “Risk Factors” beginning on page 12 of this prospectus and in the documents incorporated by reference in this prospectus and refer to the risk factors that may be included in a prospectus supplement and in our reports and other information that we file with the U.S. Securities and Exchange Commission.

Neither the U.S. Securities and Exchange Commission nor any state or Canadian securities commission or regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

__________________________

This prospectus is dated March 31, 2022.

TABLE OF CONTENTS

|

Page |

||

|

1 |

||

|

2 |

||

|

3 |

||

|

4 |

||

|

6 |

||

|

12 |

||

|

13 |

||

|

13 |

||

|

14 |

||

|

15 |

||

|

16 |

||

|

16 |

||

|

18 |

||

|

25 |

||

|

26 |

||

|

27 |

||

|

28 |

||

|

29 |

||

|

31 |

||

|

47 |

||

|

48 |

||

|

48 |

||

|

48 |

i

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. Such prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in the prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. You should read the information in this prospectus and the applicable prospectus supplement together with the additional information incorporated by reference herein as provided for under the heading “Incorporation of Certain Information by Reference.”

Owning securities may subject you to tax consequences in the United States and/or Canada. This prospectus or any applicable prospectus supplement may not describe these tax consequences fully. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.