As Filed with the Securities and Exchange Commission on February 24, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VERSUS SYSTEMS INC.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

| British Columbia | 7374 | Not Applicable | ||

(State or other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1558 West Hastings Street

Vancouver BC V6G 3J4 Canada

(604) 639-4457

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew Pierce

Versus Systems Inc.

6701 Center Drive West, Suite 480

Los Angeles, CA 90445

(310) 242-0228

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

M. Ali Panjwani, Esq. Eric M. Hellige, Esq Pryor Cashman LLP 7 Times Square New York, NY 10036 Tel: (212) 421-4100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

| Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (3) | Proposed Maximum Offering | Amount of Registration Fee | ||||||||||||

| Common Shares, no par value | 384,000 | (2) | $ | 9.88 | $ | 3,793,920 | $ | 413.92 | ||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers any additional number of additional common shares issuable upon stock splits, stock dividends, dividends or other distribution, recapitalization or similar events with respect to the common shares being registered pursuant to this registration statement. |

| (2) | Represents common shares issuable upon exercise of certain warrants at an exercise price of $7.50 per share issued by the registrant in a private placement on January 20, 2021. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(g) and Rule 457(c) under the Securities Act, based upon the higher of (i) the price at which the warrants may be exercised and (ii) the average of the high and low prices for a share of the registrant’s common shares as reported on the Nasdaq Capital Market on February 23, 2021. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED FEBRUARY 24, 2021 |

384,000 Shares

VERSUS SYSTEMS INC.

This prospectus relates to the resale, from time to time, by Casing & Co. FBO Wasatch Micro Cap Fund (the “Selling Shareholder”) of an aggregate of 384,000 of our common shares, no par value, issuable upon exercise of certain outstanding warrants we issued on January 20, 2021 (the “Warrants”).

We are not selling any securities under this prospectus and we will not receive proceeds from the sale of our common shares by the Selling Shareholder. However, we may receive proceeds from the cash exercise of the Warrants, which, if exercised in cash at the current applicable exercise price with respect to all of the 384,000 common shares, would result in gross proceeds to us of approximately $2.9 million. We issued the Warrants to the Selling Shareholder under a purchase agreement, dated January 30, 2021 (the “Purchase Agreement”), for gross proceeds of $20,000 on January 20, 2021. For a more detailed description of the Warrants, see “Issuance of Warrants to Selling Shareholder.”

We will pay the expenses of registering the common shares offered by this prospectus, but all selling and other expenses incurred by the Selling Shareholder will be paid by the Selling Shareholder. The Selling Shareholder may sell our common shares offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described in this prospectus under “Plan of Distribution.” The prices at which the Selling Shareholder may sell shares will be determined by the prevailing market price for our common shares or in negotiated transactions.

Our common shares are presently quoted on The Nasdaq Capital Market, or Nasdaq, under the symbol “VS” and on the Canadian Securities Exchange, or the CSE, under the symbol “VS”. On February 16, 2021, the last reported sale price for our common shares on Nasdaq was US$11.14 and on the CSE was C$14.10. Our common shares will cease to be quoted on the CSE on February 25, 2021 as a result of our voluntary delisting from that exchange.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and a “foreign private issuer” under applicable Securities and Exchange Commission rules and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary – Implications of Being an Emerging Growth Company and a Foreign Private Issuer.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2021.

TABLE OF CONTENTS

i

The registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus.

You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading “Where You Can Find Additional Information.”

You should rely only on the information contained in this prospectus. Neither we nor the Selling Shareholder have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

The Selling Shareholder is not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither we nor the Selling Shareholder have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe any restrictions relating to this Offering and the distribution of this prospectus applicable to that jurisdiction.

Unless the context otherwise requires, the terms “ our company,” “Company, ”“we,” “us” and “our” refer to Versus Systems Inc. and our subsidiaries.

All service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ®, © and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

We publish our consolidated financial statements in Canadian dollars. In this prospectus, unless otherwise specified, all monetary amounts are in United States dollars, all references to “$” and “C$” mean Canadian dollars and all references to “US$,” “USD” and “dollars” mean United States dollars.

This prospectus includes our audited annual consolidated financial statements as well as our unaudited condensed consolidated interim financial statements, or the Financial Statements. Our audited consolidated financial statements for the years ended December 31, 2019 and 2018 were prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, the independent, private-sector body that develops and approves IFRS, and Interpretations issued by the International Financial Reporting Interpretations Committee, or IFRIC. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

Unless indicated otherwise, our financial information in this prospectus has been prepared on a basis consistent with IFRS as issued by the International Accounting Standards Board. In making an investment decision, investors must rely on their own examination of our results and consult with their own professional advisors.

The share and per share information in this prospectus reflects the one-for-16 reverse stock split of our outstanding common shares that became effective on December 15, 2020.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. These statements involve risks known to us, significant uncertainties, and other factors which may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by those forward-looking statements.

Some of the statements under “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business,” and elsewhere in this prospectus constitute “forward-looking statements” that represent our beliefs, projections and predictions about future events. From time to time in the future, we may make additional forward-looking statements in presentations, at conferences, in press releases, in other reports and filings and otherwise. Forward-looking statements are all statements other than statements of historical fact, including statements that refer to plans, intentions, objectives, goals, targets, strategies, hopes, beliefs, projections, prospects, expectations or other characterizations of future events or performance, and assumptions underlying the foregoing. The words “may,” “could,” “should,” “would,” “will,” “project,” “intend,” “continue,” “believe,” “anticipate,” “estimate,” “forecast,” “expect,” “plan,” “potential,” “opportunity,” “scheduled,” “goal,” “target,” and “future,” variations of such words, and other comparable terminology and similar expressions and references to future periods are often, but not always, used to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements about the following:

| ● | our prospects, including our future business, revenues, expenses, net income, earnings per share, gross margins, profitability, cash flows, cash position, liquidity, financial condition and results of operations, backlog of orders and revenue, our targeted growth rate, our goals for future revenues and earnings, and our expectations about realizing the revenues in our backlog and in our sales pipeline; |

| ● | the potential impact of COVID-19 on our business and results of operations; |

| ● | the effects on our business, financial condition and results of operations of current and future economic, business, market and regulatory conditions, including the current economic and market conditions and their effects on our customers and their capital spending and ability to finance purchases of our products, services, technologies and systems; |

| ● | the effects of fluctuations in sales on our business, revenues, expenses, net income, earnings per share, margins, profitability, cash flows, capital expenditures, liquidity, financial condition and results of operations; |

| ● | our products, services, technologies and systems, including their quality and performance in absolute terms and as compared to competitive alternatives, their benefits to our customers and their ability to meet our customers’ requirements, and our ability to successfully develop and market new products, services, technologies and systems; |

| ● | our markets, including our market position and our market share; |

| ● | our ability to successfully develop, operate, grow and diversify our operations and businesses; |

| ● | our business plans, strategies, goals and objectives, and our ability to successfully achieve them; |

| ● | the sufficiency of our capital resources, including our cash and cash equivalents, funds generated from operations, availability of borrowings under our credit and financing arrangements and other capital resources, to meet our future working capital, capital expenditure, lease and debt service and business growth needs; |

| ● | the value of our assets and businesses, including the revenues, profits and cash flows they are capable of delivering in the future; |

| ● | the effects on our business operations, financial results, and prospects of business acquisitions, combinations, sales, alliances, ventures and other similar business transactions and relationships; |

| ● | industry trends and customer preferences and the demand for our products, services, technologies and systems; and |

| ● | the nature and intensity of our competition, and our ability to successfully compete in our markets. |

These statements are necessarily subjective, are based upon our current plans, intentions, objectives, goals, strategies, beliefs, projections and expectations, and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly-available information with respect to the factors upon which our business strategy is based, or the success of our business. Furthermore, industry forecasts are likely to be inaccurate, especially over long periods of time.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that may cause actual results, our performance or achievements, or industry results to differ materially from those contemplated by such forward-looking statements include, without limitation, those discussed under the caption “Risk Factors” in this prospectus.

iii

This summary highlights principal features of this offering and certain information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, including the information presented under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus, before making an investment decision.

Our Business

Overview

We offer a proprietary business-to-business software platform that allows video game publishers and developers, as well as other interactive media content creators, to offer in-game prizing and rewards based on the completion of in-content challenges. The prizes or rewards offered are specific to each player or viewer based on a variety of user- and content-based characteristics, including age, location, game played and challenge undertaken. Our platform facilitates several types of single player prize challenges that includes a wide range of prize types, including coupons, sweepstakes-style prizes, consumer packaged goods (“CPG”) and downloadable content (“DLC”).

We believe our platform is mutually-beneficial across three target groups. By providing in-content prizes or rewards, content providers gain increased and longer interaction by users or viewers with the media experience they offer. Consumer brands offering in-content prizes or rewards see a prolonged and increased interest from players and consumers who view their goods as a positive “win” within their viewing experience rather than as a distraction from the content they are watching as is typically the case with traditional in-content advertising. Players and consumers who are offered prizes or rewards have an increased desire to interact with such content, which increases the value of the content as a supplier of prizing opportunities, of the brands that offer the prizes, and of the experience itself as an interactive and desirable challenge.

We market our platform and its benefits to two industry segments: the owners or developers of consumer brands and their marketing and advertising professionals and the media content creators, owners and platforms. To the owners or marketers of consumer brands, we sell the opportunity to place their products as prizes or rewards in selected on-line games, media or content and we share a certain percentage of the gross receipts we receive from such customers with the owners of the media in which the prizes or rewards are offered. Our current agreements with the owners or marketers of consumer brands provide that we are paid a fee to place their ads in content, the amount of which is based either on the number of ads placed or upon the performance of those ads relative to the brand’s goals.

To content creators, owners and platforms, which currently include primarily video game developers and computer hardware manufacturers, we sell the opportunity to include our proprietary platform in their content or hardware and to use such platform as a basis for selling advertising to popular consumer brands. Our current agreements with content or game owners, including HP, Kast and Animoca Brands, provide that from 50% to 60% of advertising revenue will be kept by, or shared with, the publisher or developer, with the remaining 50% to 40% of gross receipts belonging to us. HP, our largest customer having accounted for 99.9% and 99.8% of our total net revenues during the nine-months ended September 30, 2020 and the year ended December 31, 2019, respectively, installs our platform in its OMEN and Pavilion brands of personal computers that are manufactured primarily for gamers and general use as a means of increasing usage and desirability of those computers by consumers.

Our platform allows consumers to become active advertising participants by seeking to claim the brand’s prizes or rewards as victories won through interactions with a variety of media experiences. Users are no longer “just” winning a game or streaming their favorite film. These interactions now bestow bragging rights on the consumers that extend past the media’s original purpose, resulting in winning real world goods and gaining access to experiences.

1

According to a 2018 study by the University of California, Los Angeles Center for Management of Enterprise in Media, Entertainment and Sports, the introduction of rewards benefits content providers, brands and players in the following perspectives, leading to:

| ● | 34% more play time; |

| ● | 77% more live viewers; |

| ● | 97% higher satisfaction while interacting with a virtual entertainment experience (i.e., video games); |

| ● | 10% increase in audience - 10% of players are new players, downloading the game for the first time because of prizes; and |

| ● | 4+ hours of additional engagement per week. |

Our technology facilitates advertising as a narrative, not as a distraction. By creating an environment that makes brands part of a desired experience - winning prizes or rewards - we empower content providers and brands to engage consumers more effectively and for more extended periods of time.

Our Strengths

While we believe our overall value is generated from our ability to directly increase player and viewer engagement, we see the following as our core strengths:

| ● | Choice and Earned-Rewards is a Better Model for Players. While we sell our ad units to agencies, brands and companies that seek to reach media players and viewers, our primary goal will always be to make games and media experiences more fun. Our objective is to build ad units that do not increase viewer/player churn, but in fact increase player engagement. We believe our focus on how the player views the experience - offering them choice and an opportunity to both earn the reward and achieve the gratification of a successful win - will be the key differentiator in the in-game and in-app advertising market. While other competitors in the advertising industry may have more reach at the moment, we believe the increasing numbers of players who want the superior experience of rewards rather than banner ads, commercials and un-skippable videos will ultimately win out. |

| ● | Our Team is Diverse, Accomplished and Effective. We have brought together experts in the game industry, software development, advertising, product design and development, and corporate finance. Our Executive Chair, Keyvan Peymani, was the Head of Startup Marketing for Amazon Web Services, and our advisory board includes the former Vice President of Revenue for Activision Blizzard, the Chief Executive Officer of Radley Media, and a number of veterans of the global gaming industry. Our designers and engineers have built hundreds of successful products from games and apps, including the NFL.com fantasy football platform. We are curious, creative, community-oriented problem solvers who have come together to make a world-class software solution. As a result, we have won multiple awards as one of the best places to work in Los Angeles, and one of the best places to work anywhere for millennial women. We are extremely proud of our team and our culture. We believe it allows us to hire, retain, promote and develop the very best talent. |

| ● | Our Technology is Robust, Scalable and Flexible. We have architected a platform that will allow any content publisher to integrate real-world prizes into their system, and allow any brand or agency to place their products, discounts, codes and coupons into an earned-rewards framework. We have software development kits that are compatible with millions of games and apps, as well as ways to work with iOS and Android devices, PCs, consoles, Apple TVs, and other peripherals. The back end of our platform is built in Elixir by some of the world-experts in that language. The Elixir back end allows the type of massively scalable system that will be required for AAA games and app partners with millions of users. The strengths of the code base are its ability to manage huge numbers of concurrent users with localized failure - such that if there is an issue with a single player’s match it does not affect larger portions of the system. We can add new features, new games and entire new verticals easily. We can also adapt to changing regulatory environments around prizing, sweepstakes, privacy and other issues by managing our geofencing for where any given prize is offered. Our Dynamic Regulatory Compliance system is the direct result of years of thoughtful system architecture and development - an achievement that we believe sets us apart from competitors. |

2

| ● | Our IP portfolio is Strong and Growing. We have been issued two key patents from the U.S. Patent and Trademark Office (USPTO) with dozens of granted claims around how to offer players prizes in-game at scale. We have been awarded claims covering how to maintain and promote competitive balance in multiplayer games, how to use multi-factor tests to serve up only relevant prizing on a per-player basis, how to use a player’s location, game and age to determine eligibility for certain kinds of prizes in certain kinds of single player games, competitive games, tournaments, and synchronous and asynchronous matches. We have several other patent filings in various stages of review at the USPTO and we are working with our technology and legal teams to develop new and defensible IP in this space. We want to be the only real solution for global in-game and in-app rewards. |

| ● | The Support of Our Partners Helps us Grow. Our rewards platform is currently deployed in all HP OMEN and HP Pavilion Gaming laptops and desktop computers in the U.S., and we launched our platform with HP in China in August 2020. Our multi-year agreement with HP is to bring rewards to all their players worldwide as a way to differentiate HP hardware and to engage with a massive global audience. Beyond HP, we are also partnered with Animoca Brands, a developer of on-line and mobile games that have been downloaded hundreds of millions of times. We have also partnered with Ludare, a licensed mobile game developer that makes licensed games for titles in the Men In Black series. Beyond gaming, we are working with Kast, a video-sharing application with millions of viewers, and are developing partnerships in the fitness/health and wellness industries. As we grow our user base, we believe we will become more desirable for brand and advertising partners and we expect to increase our transactional revenues exponentially while staying on a capital-efficient low-cost trajectory. |

Our Growth Strategy

While other forms of advertising technology focus mostly upon increasing monetization only for the advertiser, we believe we change the universe of beneficiaries significantly. Our approach creates simultaneous wins for content providers, brands and consumers. We believe today’s audiences not only seek engagement, but are also consummate purveyors of media, with no shortage of content choice. We recognize that keeping engagement high is the key to changing the negative association of traditional media advertising. By creating a prizing opportunity, brand introductions mean a chance to win rather than switching to another tab, source or device while waiting for selected content to return.

Our growth strategy can be summarized into three areas: grow the audience, grow the prize provider pool, and then constantly iterate and improve.

The key elements of our long-term growth strategy include:

| ● | Increase Applications and Verticals. To grow our user base, we will seek to increase the number of games, applications and content providers that have integrated our platform across an increasing number of industries. Part of that process will involve making our platform easier to integrate into a wide variety of media, which we are doing, but the rest is putting our value proposition in front of a larger group of game and app developers. Integrating into new categories and industries allows us a greater pool of potential applications with which to integrate, and therefore a greater pool of potential users. We intend to focus on gaming, streaming media, and health & wellness applications, but may seek to expand to other verticals as opportunities arise. We believe this will significantly grow our user base. |

| ● | Integrate Into More Devices and Software Languages. Our platform is currently available in applications running on laptops and desktops, as well as in mobile devices powered by iOS and Android operating systems through a series of software development kits (SDKs) that we have created. We strive to make our rewards platform available to, and compatible with, all kinds of devices. The current engineering roadmap includes additional support for the tens of millions of console gaming systems like the new Xbox and PlayStation consoles. We are also developing features for a number of wearable devices that are in the marketplace, which we believe will increase our user base in the health & wellness vertical. |

| ● | Develop a Global Reach. The United States is one of the world’s largest gaming markets, with nearly $37 billion in annual revenue according to a Newzoo 2020 Global Games Report. We intend to deepen our penetration of the U.S. market. However, we believe there is significant opportunity for expansion of our offerings into the rest of the world, starting with Asia and Europe. In August 2020, our platform became available for the first time in China, and we plan to expand in Asia and move into Europe in 2021. Because our platform is built to optimize value for a player based on his or her location, we believe we are uniquely positioned to offer location-specific rewards and prizes for players all over the world. As we move into new geographies, we believe we will gain new players and new brands and prize providers that can offer real, local value. |

3

| ● | Add More Prizing Partners. Increasing the number of prize providers - the largest growth area for our company - and the one that will be the most lucrative - is at the center of our growth strategy. We have built out a sales team and we are adding both salespeople and sales assets to pursue both agencies and individual vendors who may want to use our platform to promote their businesses. At the same time, we are also working to make our tools easier for prizing partners to use - including building functionality for businesses that use e-commerce platforms such as the Shopify platform, and for others who want to self-direct their prizing campaigns. |

| ● | Constantly Improve Outcomes. We are dedicated to improving the quality of the outcomes for our partners. We have developed a number of tools to evaluate the efficacy of each advertising campaign, and part of our value to our brand partners is providing them with anonymized but actionable information on each of their campaigns on our platform. Our analytics are focused on response rates, transaction rates, customer acquisition cost, and many other aspects of the step-by-step funnel from activation to registration, all the way through to lifetime customer value. We continually review outcomes and if there is a way to improve the transaction rate - to get winners, players or viewers to engage with our brand partners while retaining our core goal of making the media more fun - then we will make the necessary changes to improve those outcomes. This core tenet of our approach requires dedication to research, player and user outreach, surveys, and constant design improvements. We believe this strategy will produce yields in loyalty, affinity and Return on Ad Spend (ROAS) for our partners, which will drive future growth. |

| ● | Grow Revenues and Market Share. We are always looking for opportunities to grow through selective acquisitions and while much of our current roadmap is devoted to organic growth, we are also aware of a number of potential partnerships through which we may gain market share through inorganic growth via selective acquisition. Performance marketing is a growing field, as is interactive media advertising, and there may be opportunities to grow our sales team, our service offerings or our reach through acquisition. |

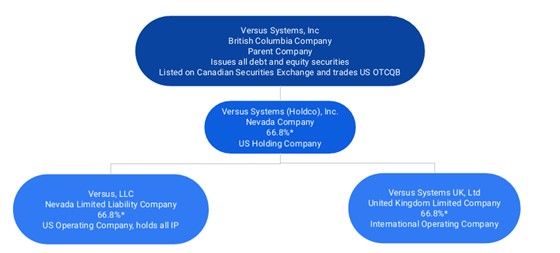

Corporate History and Structure

We were formed by way of an amalgamation under the name McAdam Resources Inc. in the Province of Ontario on December 1, 1988 and subsequently extraprovincially registered in British Columbia on February 2, 1989. We changed our name to Boulder Mining Corporation on May 9, 1995 in Ontario and on September 25, 1996 in British Columbia. We continued into British Columbia on January 2, 2007 and concurrently changed our name to Opal Energy Corp. We changed our name to Versus Systems Inc. on June 30, 2016.

On June 26, 2016, we acquired a 37.5% ownership interest in Versus LLC, a privately-held limited liability company organized under the laws of the state of Nevada and then engaged in our current line of business, from existing members (the “Selling Members”) in consideration of a cash payment of CDN$1,962,722 (US$1,500,000). On June 30, 2016, we and the Selling Members exchanged 100% of their ownership units in Versus LLC for 8,950.05 common shares of Versus Systems (Holdco) Inc. (formerly known as “Opal Energy (Holdco) Corp.”, hereafter referred to as “Holdco”). Consequently, Versus LLC became a wholly-owned subsidiary of Holdco. This share exchange resulted in a reduction of our ownership interest in Holdco from 100% to 38.2%. In addition, we acquired full voting control over all of the Holdco shares held by the Selling Members in exchange for granting them the right to exchange their Holdco shares for such number of our common shares equal to a total value of US$2,500,000, and common share purchase warrants with a total value of US$1,250,000 at an exercise price of CDN$3.20 per share until June 30, 2019. Thereafter, we acquired additional shares of Holdco from the Selling Members through multiple shares purchase transactions and increased our ownership interest in Holdco to 66.8% on June 21, 2019.

Versus Systems UK Ltd. was formed under the Companies Act 2006 in the United Kingdom on July 26, 2019 and is wholly owned by Holdco.

The following diagram illustrates our current corporate structure:

4

Risks Associated With Our Business

Our ability to execute our business strategy is subject to numerous risks, as more fully described in the section captioned “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock and warrants. In particular, risks associated with our business include, but are not limited to, the following:

| ● | We have a relatively limited operating history and limited revenues to date and thus are subject to risks of business development and you have no basis on which to evaluate our ability to achieve our business objective. |

| ● | We are a holding company and depend upon our subsidiaries for our cash flows. |

| ● | Future acquisitions or strategic investments could disrupt our business and harm our business, results of operations or financial condition. |

| ● | We may require additional funding for our growth plans, and such funding may result in a dilution of your investment. |

| ● | We may not have sufficient capital to fund our ongoing operations, effectively pursue our strategy or sustain our growth initiatives. |

| ● | Changes in our relationships with our most significant customer, HP, including the loss or reduction in business from HP, could have an adverse impact on us. |

| ● | Our operations are significantly dependent on changes in public and customer tastes and discretionary spending patterns. Our inability to successfully anticipate customer preferences or to gain popularity for games may negatively impact our profitability. |

| ● | If we fail to keep up with industry trends or technological developments, our business, results of operations and financial condition may be materially and adversely affected. |

| ● | If we cannot continue to develop, acquire, market and offer new products and services or enhancements to existing products and services that meet customer requirements, our operating results could suffer. |

| ● | We make significant investments in new products and services that may not achieve expected returns. |

| ● | If we fail to retain existing users or add new users, our results of operations and financial condition may be materially and adversely affected |

| ● | Our insurance coverage may not adequately protect us against all future risks, which may adversely affect our business and prospects. |

| ● | Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations. |

| ● | Our executive officers, directors, security holders and their respective affiliates may have competitive pecuniary interests that conflict with our interests. |

| ● | Public health epidemics or outbreaks, such as COVID-19, could materially and adversely impact our business. |

| ● | Our business may be harmed if our licensing partners, or other third parties with whom we do business, act in ways that put our brand at risk. |

| ● | If we fail to keep our existing users highly engaged, to acquire new users, to successfully implement an award-prizes model for our user community, our business, profitability and prospects may be adversely affected. |

| ● | Our failure to protect our intellectual property rights may undermine our competitive position. |

| ● | Our business is highly dependent on the proper functioning and improvement of our information technology systems and infrastructure. Our business and operating results may be harmed by service disruptions, or by our failure to timely and effectively scale up and adjust our existing technology and infrastructure. |

5

Recent Developments

Reverse Stock Split. On December 8, 2020, our board of directors approved a one-for-16 reverse stock split of our common shares. Pursuant to applicable rules of the CSE, the reverse share split became effective on December 15, 2020. The conversion or exercise prices of our issued and outstanding convertible securities, stock options and warrants were adjusted accordingly. All share and per share amounts and the corresponding conversion price or exercise price data presented in this prospectus gives effect to such reverse stock split of our outstanding common shares.

Public Securities Offering. On January 20, 2021, we completed a public offering (the “Public Offering”) in which we sold an aggregate of 1,280,000 units, with each unit consisting of one common share and two warrants, one Unit A Warrant with a term of five years and one Unit B Warrant with a term of one year, each to purchase one additional common share at an exercise price of $7.50 per share. The Public Offering was priced at $7.50 per unit, for gross proceeds of US$11,040,000, including the gross proceeds received as a result of the exercise of the over-allotment option by the underwriter in the Public Offering to purchase 192,000 additional common shares at US$7.50 per common share, before deducting underwriting discounts and commissions and other offering expenses payable by us. We intend to use the net proceeds of the offering, which amounted to approximately US$2,600,000, for working capital and general corporate purposes.

In connection with the Public Offering, we sold the underwriter in the Public Offering an additional 192,000 Unit A Warrants and 192,000 Unit B Warrants (collectively, the “Warrants”) in a private placement for aggregate consideration of $20,000, which Warrants were issued to the Selling Shareholder at the direction of the underwriter. See “Sale of Warrants to Selling Shareholder.”

Our Corporate Information

We operate through our majority-owned subsidiary, Versus LLC, a Nevada limited liability company that was organized on August 21, 2013. Our principal executive offices in Canada are located at 1558 Hastings Street, Vancouver, British Columbia V6G 3J4 Canada, and our telephone number is (604) 639-4457. Our principal executive offices in the United States are located at 6701 Center Drive West, Suite 480, Los Angeles, CA 90045, and our telephone number at that address is (424) 226-8588. Our website address is www.versussystems.com. The information on or accessed through our website is not incorporated in this prospectus or the registration statement of which this prospectus forms a part.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible for exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies, including, but not limited to, presenting only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation, and an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or golden parachute arrangements.

In addition, an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this provision of the JOBS Act. As a result, we will not be subject to new or revised accounting standards at the same time as other public companies that are not emerging growth companies. Therefore, our consolidated financial statements may not be comparable to those of companies that comply with new or revised accounting pronouncements as of public company effective dates.

We will remain an emerging growth company until the earliest of: (i) the last day of the fiscal year following the fifth anniversary of the consummation of this offering; (ii) the last day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion; (iii) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our common shares held by non-affiliates exceeded $700.0 million as of the last business day of the second fiscal quarter of such year; or (iv) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

In addition, upon consummation of this offering, we will report under the Exchange Ac, as a non-U.S. company with foreign private issuer status. As a foreign private issuer, we may take advantage of certain provisions in the Nasdaq Listing Rules that allow us to follow Canadian law for certain corporate governance matters. See “Management—Foreign Private Issuer Status.” Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events; and |

| ● | Regulation Fair Disclosure, or Regulation FD, which regulates selective disclosures of material information by issuers. |

6

| Securities offered by the Selling Shareholder: | 384,000 common shares | |

| Common shares to be outstanding after the offering: | 12,801,845 shares | |

| Common shares to be outstanding after the offering assuming exercise of all Warrants: | 13,185,845 shares | |

| Use of Proceeds: | We will not receive any proceeds from the sale by the Selling Shareholder of the common shares being offered by this prospectus. | |

| Risk Factors: | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 9 before deciding to invest in our securities. | |

| Trading Symbol: | Our common shares are currently quoted on The Nasdaq Capital Market and on the CSE, each under the trading symbol “VS”. Our shares will cease trading on the CSE on February 25th, 2021 per our voluntary delisting. |

The 12,801,845 common shares to be outstanding after this offering is based on 12,801,845 shares outstanding as of February 16, 2021. The 12,801,845 common shares to be outstanding after this offering excludes the following:

| ● | 6,284,741 common shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $3.47; |

| ● | 1,353,831 common shares reserved for issuance upon the exercise of outstanding stock options at December 31, 2020 with a weighted average exercise price of $4.64 issued pursuant to our 2017 Stock Option Plan; and |

| ● | 309,548 common shares issuable upon conversion of outstanding Versus Systems (Holdco) shares. |

7

SELECTED SUMMARY HISTORICAL FINANCIAL INFORMATION

The following tables set forth a summary of our historical consolidated financial data as of and for the periods indicated. We have derived the summary consolidated statements of operations and comprehensive loss data for the years ended December 31, 2019 and 2018 from our audited consolidated financial statements, which were prepared in accordance with IFRS, and are included elsewhere in this prospectus. We have derived the summary consolidated statements of operations and comprehensive loss data for the nine months ended September 30, 2020 and 2019 and the consolidated balance sheet data as of September 30, 2020 from our unaudited interim consolidated financial statements included elsewhere in this prospectus. You should read this data together with our consolidated financial statements and related notes included elsewhere in this prospectus and the information in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The summary consolidated financial data included in this section are not intended to replace the consolidated financial statements and related notes and is qualified in their entirety by our consolidated financial statements and related notes included elsewhere in this prospectus. Our consolidated financial statements have been prepared in accordance with IFRS and are presented in Canadian dollars except where otherwise indicated. Our historical results are not necessarily indicative of the results to be expected for any other period and our interim results are not necessarily indicative of the results to be expected for the full year ending December 31, 2020.

| Nine Months Ended September 30, | Year Ended December 31, | |||||||||||||||

| (in C$, except share and per share data) | 2020 | 2019 | 2019 | 2018 | ||||||||||||

| (unaudited) | ||||||||||||||||

| Consolidated Statements of Operations and Comprehensive Loss Data: | ||||||||||||||||

| Revenues | ||||||||||||||||

| Revenue | $ | 1,368,924 | $ | 654,324 | $ | 664,922 | $ | 1,620 | ||||||||

| Expenses | ||||||||||||||||

| Amortization | 246,802 | 252,838 | 327,221 | 29,642 | ||||||||||||

| Amortization of intangible assets | 1,314,342 | 2,379,591 | 2,530,590 | 2,965,035 | ||||||||||||

| Consulting fees | 511,815 | 625,560 | 814,128 | 1,177,405 | ||||||||||||

| Foreign exchange loss (gain) | 210,419 | 53,868 | 38,797 | 147,273 | ||||||||||||

| Employee benefit and other expense | 773,270 | 856,347 | 669,586 | 1,305,652 | ||||||||||||

| Interest expense | 179,386 | 128,333 | 225,334 | 77,669 | ||||||||||||

| Interest expense on lease obligations | 63,500 | 81,940 | 104,384 | - | ||||||||||||

| Professional fees | 873,872 | 320,093 | 445,603 | 621,979 | ||||||||||||

| Salaries and wages | 1,953,921 | 2,178,669 | 3,252,789 | 2,074,554 | ||||||||||||

| Sales and marketing | 230,952 | 657,582 | 787,398 | 199,412 | ||||||||||||

| Share-based compensation | 1,161,925 | 577,987 | 839,249 | 651,316 | ||||||||||||

| (6,151,280 | ) | (7,458,484 | ) | (9,370,157 | ) | (9,248,487 | ) | |||||||||

| Finance expense | (293,583 | ) | (193,811 | ) | - | 1,219 | ||||||||||

| Loss on disposal of marketable securities | (508,050 | ) | - | - | - | |||||||||||

| Other expense | (80,085 | ) | 299 | (257,448 | ) | (125,903 | ) | |||||||||

| Loss and comprehensive loss | $ | (7,032,998 | ) | $ | (7,651,996 | ) | $ | (9,627,605 | ) | $ | (9,373,171 | ) | ||||

| Loss and comprehensive loss attributable to: | ||||||||||||||||

| Shareholders | $ | (5,649,107 | ) | $ | (3,918,329 | ) | $ | (6,869,121 | ) | $ | (4,631,477 | ) | ||||

| Non-controlling interest | (1,383,891 | ) | (3,733,667 | ) | (2,758,484 | ) | (4,741,694 | ) | ||||||||

| $ | (7,032,998 | ) | $ | (7,651,996 | ) | $ | (9,627,605 | ) | $ | (9,373,171 | ) | |||||

| Basic and diluted loss per common share attributable to Versus Systems Inc. | $ | (0.62 | ) | $ | (0.60 | ) | $ | (0.98 | ) | $ | (0.86 | ) | ||||

| Weighted average common shares outstanding | 9,072,768 | 6,561,903 | 7,032,150 | 5,398,326 | ||||||||||||

| September 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| (in C$) | (unaudited) | |||||||

| Consolidated Balance Sheet Data: | ||||||||

| Cash | $ | 21,954 | $ | 99,209 | ||||

| Property and equipment | 702,196 | 948,998 | ||||||

| Intangible assets | 2,339,052 | 2,780,347 | ||||||

| Total assets | 3,315,678 | 4,042,354 | ||||||

| Current liabilities | 4,554,952 | 1,303,778 | ||||||

| Non-current notes payable | 3,873,863 | 4,814,767 | ||||||

| Total liabilities | 9,018,259 | 6,912,572 | ||||||

| Total liabilities and equity | 3,315,678 | 4,042,354 | ||||||

8

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, including our historical financial statements and related notes included elsewhere in this prospectus, before you decide to purchase our securities. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our common shares and warrants. Refer to “Cautionary Note Regarding Forward-Looking Statements.”

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to Our Business

We have a relatively limited operating history and limited revenues to date and thus are subject to risks of business development and you have no basis on which to evaluate our ability to achieve our business objective.

Because we have a relatively limited operating history and limited revenues to date, you should consider and evaluate our operating prospects in light of the risks and uncertainties frequently encountered by early-stage operating companies in rapidly evolving markets. These risks include:

| ● | that we may not have sufficient capital to achieve our growth strategy; |

| ● | that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; |

| ● | that our growth strategy may not be successful; and |

| ● | that fluctuations in our operating results will be significant relative to our revenues. |

Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business could be significantly harmed. To date, we have had minimal revenues. Even if we do achieve profitability, we cannot predict the level of such profitability. If we sustain losses over an extended period of time, we may be unable to continue our business.

We are a holding company and depend upon our subsidiaries for our cash flows.

We are a holding company. All of our operations are conducted, and almost all of our assets are owned, by our subsidiaries. Consequently, our cash flows and our ability to meet our obligations depend upon the cash flows of our subsidiaries and the payment of funds by these subsidiaries to us in the form of dividends, distributions or otherwise. The ability of our subsidiaries to make any payments to us depends on their earnings, the terms of their indebtedness, including the terms of any credit facilities, of which there are currently none, and legal restrictions. While there are no restrictions on the ability of our subsidiaries to make any payments to us, such restrictions may arise in the future. Any failure to receive dividends or distributions from our subsidiaries when needed could have a material adverse effect on our business, results of operations or financial condition.

Future acquisitions or strategic investments could disrupt our business and harm our business, results of operations or financial condition.

We may in the future explore potential acquisitions of companies or strategic investments to strengthen our business. Even if we identify an appropriate acquisition candidate, we may not be successful in negotiating the terms or financing of the acquisition, and our due diligence may fail to identify all of the problems, liabilities or other shortcomings or challenges of an acquired business.

9

Acquisitions involve numerous risks, any of which could harm our business, including:

| ● | straining our financial resources to acquire a company; |

| ● | anticipated benefits may not materialize as rapidly as we expect, or at all; |

| ● | diversion of management time and focus from operating our business to address acquisition integration challenges; |

| ● | retention of employees from the acquired company; |

| ● | cultural challenges associated with integrating employees from the acquired company into our organization; |

| ● | integration of the acquired company’s accounting, management information, human resources and other administrative systems; |

| ● | the need to implement or improve controls, procedures and policies at a business that prior to the acquisition may have lacked effective controls, procedures and policies; and |

| ● | litigation or other claims in connection with the acquired company, including claims from terminated employees, former shareholders or other third parties. |

Failure to appropriately mitigate these risks or other issues related to such strategic investments and acquisitions could result in reducing or completely eliminating any anticipated benefits of transactions, and harm our business generally. Future acquisitions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses or the impairment of goodwill, any of which could have a material adverse effect on our business, results of operations or financial condition.

We may require additional funding for our growth plans, and such funding may result in a dilution of your investment.

We attempted to estimate our funding requirements in order to implement our growth plans. If the costs of implementing such plans should exceed these estimates significantly or if we come across opportunities to grow through expansion plans that cannot be predicted at this time, and our funds generated from our operations prove insufficient for such purposes, we may need to raise additional funds to meet these funding requirements.

These additional funds may be raised by issuing equity or debt securities or by borrowing from banks or other resources. We cannot assure you that we will be able to obtain any additional financing on terms that are acceptable to us, or at all. If we fail to obtain additional financing on terms that are acceptable to us, we will not be able to implement such plans fully if at all. Such financing even if obtained, may be accompanied by conditions that limit our ability to pay dividends or require us to seek lenders’ consent for payment of dividends, or restrict our freedom to operate our business by requiring lender’s consent for certain corporate actions.

Further, if we raise additional funds by way of a rights offering or through the issuance of new shares, any shareholders who are unable or unwilling to participate in such an additional round of fund raising may suffer dilution in their investment.

We may not have sufficient capital to fund our ongoing operations, effectively pursue our strategy or sustain our growth initiatives.

Our remaining liquidity and capital resources may not be sufficient to allow us to fund our ongoing operations, effectively pursue our strategy or sustain our growth initiatives. The report of our independent registered public accountants on our financial statements for the years ended December 31, 2019 and 2018 stated that our negative cash flows from operations, inability to finance our day-to-day operations through operations and expectation of further losses indicates that a material uncertainty exists that may cast significant doubt on our ability to continue as a going concern. If we require additional capital resources, we may seek such funds directly from third party sources; however, we may not be able to obtain sufficient equity capital and/or debt financing from third parties to allow us to fund our expected ongoing operations or we may not be able to obtain such equity capital or debt financing on acceptable terms or conditions. Factors affecting the availability of equity capital or debt financing to us on acceptable terms and conditions include:

| ● | our current and future financial results and position; |

10

| ● | the collateral availability of our otherwise unsecured assets; |

| ● | the market’s, investors’ and lenders’ view of our industry and products; |

| ● | the perception in the equity and debt markets of our ability to execute our business plan or achieve our operating results expectations; and |

| ● | the price, volatility and trading volume and history of our common shares. |

If we are unable to obtain the equity capital or debt financing necessary to fund our ongoing operations, pursue our strategy and sustain our growth initiatives, we may be forced to scale back our operations or our expansion initiatives, and our business and operating results will be materially adversely affected.

Changes in our relationships with our most significant customer, HP, including the loss or reduction in business from HP, could have an adverse impact on us.

For the nine-month period ended September 30, 2020 and the year ended December 31, 2019, one customer, HP, represented 99.9% and 99.8%, respectively, of our total net revenues. Until such time, if ever, that we are able to diversify our customer base and add additional significant customers, the loss of HP as a customer would materially impair our overall consolidated financial condition and our consolidated results of operations. Our contractual relationships with customers, including HP, generally are terminable at will by the customers on short notice and do not require the customer to provide any minimum commitment. Our customers could choose to divert all or a portion of their business with us to one of our competitors, demand rate reductions for our services, require us to assume greater liability that increases our costs, or develop their own prizing or rewards capabilities. Failure to retain our existing customers or enter into relationships with new customers could materially impact the growth in our business and our ability to meet our current and long-term financial forecasts.

Our operations are significantly dependent on changes in public and customer tastes and discretionary spending patterns. Our inability to successfully anticipate customer preferences or to gain popularity for games may negatively impact our profitability.

Our success depends significantly on public and customer tastes and preferences, which can be unpredictable. If we are unable to successfully anticipate customer preferences or increase the popularity of the games that have embedded at our platform, the per capita revenue and overall customer expenditures may decrease, and thereby negatively impact our profitability. In response to such developments, we may need to increase our marketing and product development efforts and expenditures, we may also adjust our product pricing, we may modify the platform itself, or take other actions, which may further erode our profit margins or otherwise adversely affect our results of operations and financial condition. In particular, we may need to expend considerable cost and effort in carrying out extensive research and development to assess the potential interest in our platform and to remain abreast with continually evolving technology and trends.

While we may incur significant expenditures of this nature, including in the future as we continue to expand our operations, there can be no assurance that any such expenditures or investments by us will yield expected or commensurate returns or results, within a reasonable or anticipated time, or at all.

If we fail to keep up with industry trends or technological developments, our business, results of operations and financial condition may be materially and adversely affected.

The gaming industry is rapidly evolving and subject to continuous technological changes. Our success depends on our ability to continue to develop and implement services and solutions that anticipate and respond to rapid and continuing changes in technology and industry developments and offerings to serve the evolving needs of our customers. Our growth strategy is focused on responding to these types of developments by driving innovation that will enable us to expand our business into new growth areas. If we do not sufficiently invest in new technology and industry developments, or evolve and expand our business at sufficient speed and scale, or if we do not make the right strategic investments to respond to these developments and successfully drive innovation, our services and solutions, our results of operations, and our ability to develop and maintain a competitive advantage and continue to grow could be negatively affected. In addition, we operate in a quickly evolving environment in which there currently are, and we expect will continue to be, new technology entrants. New services or technologies offered by competitors or new entrants may make our offerings less differentiated or less competitive, when compared to other alternatives, which may adversely affect our results of operations. Technological innovations may also require substantial capital expenditures in product development as well as in modification of products, services or infrastructure. We cannot assure you that we can obtain financing to cover such expenditures. Failure to adapt our products and services to such changes in an effective and timely manner could materially and adversely affect our business, financial condition and results of operations.

11

If we cannot continue to develop, acquire, market and offer new products and services or enhancements to existing products and services that meet customer requirements, our operating results could suffer.

The process of developing and acquiring new technology products and services and enhancing existing offerings is complex, costly and uncertain. If we fail to anticipate customers’ rapidly changing needs and expectations, our market share and results of operations could suffer. We must make long-term investments, develop, acquire or obtain appropriate intellectual property and commit significant resources before knowing whether our predictions will accurately reflect customer demand for our products and services. If we misjudge customer needs in the future, our new products and services may not succeed and our revenues and earnings may be harmed. Additionally, any delay in the development, acquisition, marketing or launch of a new offering or enhancement to an existing offering could result in customer attrition or impede our ability to attract new customers, causing a decline in our revenue or earnings.

We make significant investments in new products and services that may not achieve expected returns.

We have made and will continue to make significant investments in research, development and marketing for existing products, services and technologies, including developing new Software Development Kits (SDKs) for console gaming, wearables, smart TV systems, AR/VR, new feature sets for our core products, and entirely new products and platforms that we are developing for specific customers, as well as new technology or new applications of existing technology. Investments in new technology are speculative. Commercial success depends on many factors, including but not limited to innovativeness, developer support, and effective distribution and marketing. If customers do not perceive our latest offerings as providing significant new functionality or other value, they may reduce their purchases of our services or products, unfavorably affecting our revenue and profits. We may not achieve significant revenue from new product, service or distribution channel investments, or new applications of existing new product, service or distribution channel investments, for several years, if at all. New products and services may not be profitable, and even if they are profitable, operating margins for some new products and businesses may not be as high as the margins we have experienced historically. Furthermore, developing new technologies is complex and can require long development and testing periods. Significant delays in new releases or significant problems in creating new products or offering new services could adversely affect our revenue and profits.

If we fail to retain existing users or add new users, our results of operations and financial condition may be materially and adversely affected

The size of our users’ level of engagement are critical to our success. Our financial performance will be significantly determined by our success in having our products adding, retaining, and engaging active users. To the extent that our active user growth rate slows, our business performance will become increasingly dependent on our ability to increase levels of user engagement in current and new markets. If people do not perceive our products to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A decrease in user retention, growth, or engagement could render us less attractive to video game publishers and developers which may have a material and adverse impact on our revenue, business, financial condition, and results of operations. Any number of factors could potentially negatively affect user retention, growth, and engagement, including if:

| ● | users increasingly engage with competing products; |

| ● | we fail to introduce new and improved products or if we introduce new products or services that are not favorably received; |

12

| ● | we are unable to successfully balance our efforts to provide a compelling user experience with the decisions made by us with respect to the frequency, prominence, and size of ads and other commercial content that we display; |

| ● | there are changes in user sentiment about the quality or usefulness of our products or concerns related to privacy and sharing, safety, security, or other factors; |

| ● | we are unable to manage and prioritize information to ensure users are presented with content that is interesting, useful, and relevant to them; |

| ● | there are adverse changes in our products that are mandated by legislation, regulatory authorities, or litigation, including settlements or consent decrees; |

| ● | technical or other problems prevent us from delivering our products in a rapid and reliable manner or otherwise affect the user experience; |

| ● | we adopt policies or procedures related to areas such as sharing our user data that are perceived negatively by our users or the general public; |

| ● | we fail to provide adequate customer service to users, developers, or advertisers; or |

| ● | we, our software developers, or other companies in our industry are the subject of adverse media reports or other negative publicity. |

If we are unable to build and/or maintain relationships with publishers and developers, our revenue, financial results, and future growth potential may be adversely affected.

Our insurance coverage may not adequately protect us against all future risks, which may adversely affect our business and prospects.

We maintain insurance coverage, including for fire, acts of god and perils, terrorism, burglary, money, fidelity guarantee, professional liability including errors and omissions and breach of contract, commercial property, commercial general liability, cyber events including incident response costs, legal, forensic and breach management costs, cyber-crimes, system damage, rectification costs, business interruption and reputational harm, as well as directors’ and officers’ liability insurance and employee health and medical insurance, with standard exclusions in each instance. While we maintain insurance in amounts that we consider reasonably sufficient for a business of our nature and scale, with insurers that we consider reliable and credit worthy, we may face losses and liabilities that are uninsurable by their nature, or that are not covered, fully or at all, under our existing insurance policies. Moreover, coverage under such insurance policies would generally be subject to certain standard or negotiated exclusions or qualifications and, therefore, any future insurance claims by us may not be honored by our insurers in full, or at all. In addition, our premium payments under our insurance policies may require a significant investment by us.

To the extent that we suffer loss or damage that is not covered by insurance or that exceeds our insurance coverage, the loss will have to be borne by us and our business, cash flow, financial condition, results of operations and prospects may be adversely affected.

Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations.

We are subject to laws and regulations enacted by national, regional and local governments. In particular, we are required to comply with certain SEC and other legal requirements. Compliance with, and monitoring of, applicable laws and regulations may be difficult, time consuming and costly. Those laws and regulations and their interpretation and application may also change from time to time and those changes could have a material adverse effect on our business, investments and results of operations. In addition, a failure to comply with applicable laws or regulations, as interpreted and applied, could have a material adverse effect on our business and results of operations.

We are dependent upon our executive officers and directors and their departure could adversely affect our ability to operate.

Our operations are dependent upon a relatively small group of individuals and, in particular, our executive officers and directors. We believe that our success depends on the continued service of our executive officers and directors. We do not have key-man insurance on the life of any of our directors or executive officers. The unexpected loss of the services of one or more of our directors or executive officers could have a detrimental effect on us.

13

Our executive officers, directors, security holders and their respective affiliates may have competitive pecuniary interests that conflict with our interests.

We have not adopted a policy that expressly prohibits our directors, executive officers, security holders or affiliates from having a direct or indirect pecuniary or financial interest in any investment to be acquired or disposed of by us or in any transaction to which we are a party or have an interest. We do not have a policy that expressly prohibits any such persons from engaging for their own account in business activities of the types conducted by us. Accordingly, such persons or entities may have a conflict between their interests and ours.

Public health epidemics or outbreaks, such as COVID-19, could materially and adversely impact our business.

In December 2019, a novel strain of coronavirus (COVID-19) emerged in Wuhan, Hubei Province, China. While initially the outbreak was largely concentrated in China and caused significant disruptions to its economy, it has now spread to several other countries and infections have been reported globally. Because COVID-19 infections have been reported throughout the United States, certain federal, state and local governmental authorities have issued stay-at-home orders, proclamations and/or directives aimed at minimizing the spread of COVID-19. Additional, more restrictive proclamations and/or directives may be issued in the future.